The big picture of microfinance is about loans, money transfers, insurance and, in some cases, deposits, just like in the “normal world”. But all the differentiating details eventually create a very specific need, and that must be addressed accordingly.

What Does Microfinance Stand For?

Though its history can be traced back to the 1800s, microfinance first gained prominence during the 1970s and is nowadays considered a tool for socio-economic development, meant to reduce income inequality, by allowing citizens from lower socio-economical classes to participate in the economy.

Microfinance institutions (MFIs) serve different clienteles than banks, mainly people who have little access to regular banking services and who need to make frequent small value loans. Hence, compared to banks, MFIs capture other aspects of financial development, also having a different impact on poverty alleviation, and often serving rural communities, especially in developing countries, where banks have little to no presence.

This, in turn, leads to distinct needs that must be addressed separately, through customized (and customizable) products and services.

How Can Allevo Help Microfinance Institutions Strive?

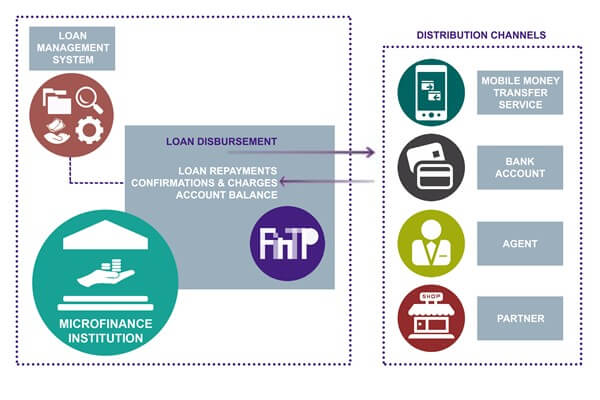

Allevo’s Operations Management solution for microfinance institutions offers flow automation, compliance to standards and integration with banks on one side and various distribution channels like mobile money transfer operators on the other.

FinTP retrieves loan disbursements from the internal systems of an MFI, converts them into the ISO 20022 internal format and prepares them to be sent to the intended distribution channel in the specific format – APIs, database, XML or agnostic files etc.

The business flow is fully automated, allowing operators to have an instant view on intraday activities and take action in outstanding situations.

In terms of integration, FinTP connects to internal loan management systems, accounting and customer databases and fetches disbursements ready to be sent to any type of distribution channel:

- agent network

- partner network

- mobile money transfer (MMT) services

Disbursements can be split into multiple sub-transactions of a predefined maximum amount to lower risk on one hand, and to ensure they can be processed by the distribution channel on the other. In most cases, this limit is a requirement imposed by the MMT and it is the for compliance purposes.

Loan repayments are automatically matched to existing outgoing disbursements. If a match cannot be made, they are labeled as outstanding payments that need to be investigated by the operator.

System and network confirmations are automatically attached to the original outgoing disbursement, allowing for the operator to see the status of a loan at any given point in time.

Any incoming charges or fees are processed and sent to internal back-office or accounting systems.

FinTP also filters disbursements, ensuring that no duplicates are being processed and sent to external systems, and it has the capability to cross check the beneficiary against custom black or white lists (credit scoring, anti-money laundering, anti-terrorist regulations).

These being said, should you play a role in an MFI aiming for constant improvement, why not give our solution a try?