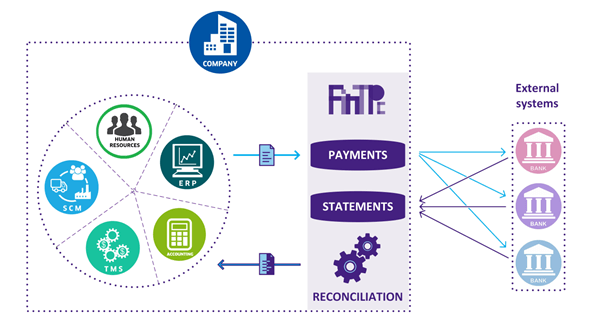

Our corporate treasury solution – FinOps Suite* – is based on FinTPc, one of the dear cousins of the FinTP product that banks use to achieve straight through processing and much more.

One of the things to love about it is the otherwise underrated account reconciliation… Reconciliation is a critical control for your business and its automation significantly increases your overall efficiency.

Ten months into our FinOps Suite project, it’s high time you took a look at one of the reconciliation flows that FinTPc offers, the one that matches payments with debit transactions from bank statements.

FinTPc Reconciliation Steps (Automatic / Manual)

- FinTPc fetches payment files from the corporate’s core applications (Human Resources, Accounting, etc.)

- Groups of payments are authorized by users in order to send them to the banks.

- FinTPc fetches statements from each bank involved.

- According to the criteria previously defined in the application, the debit records from the fetched statements and the payments sent to banks are submitted for automatic reconciliation.

- If all defined criteria are matched, the transactions involved are automatically matched.

- If only a subset of defined criteria is matched, the transactions involved are offered, in order to be manually confirmed or rejected by users.

- Also, the application allows users to select a transaction to be manually matched. In this case, after selecting the transaction, the user needs to select the pair of this transaction and manually match them.

- For monitoring and decision-making purposes, custom reconciliation reports are available for operations or business users.

In a very similar manner, FinTPc also reconciles issued invoices with credit transactions, as well as received invoices with debit transactions from bank statements.

Should any of the above ring a bell, feel free to get in touch with us for more info and learn how our services can benefit your business in more ways than one.

*FinOps Suite is the business name of the software solution being developed within our Treasure Open Source Software (TOSS) project. This project is co-financed by the European Regional Development Fund under the Competitiveness Operational Programme 2014-2020, Priority Axis 2 “Information and Communications Technology (ICT) for a competitive digital economy”.

In Romanian:

Pentru informatii detaliate despre celelalte programe cofinantate de Uniunea Europeana, va invitam sa vizitati www.fonduri-ue.ro. Continutul acestui material nu reprezinta in mod obligatoriu pozitia oficiala a Uniunii Europene sau a Guvernului Romaniei. Proiect finantat in cadrul POC, Axa prioritara 2, Acțiunea 2.1, Prioritate de investitii 2b. Cod MySMIS: 115724, Nr. Contract Finantare: 101/16.08.2017.