Context

Allevo and Bakken & Bæck are almost finalizing the implementation of the Whizzer project. The project benefits from an EEA & Norway Grants grant investment operated by Innovation Norway, SMEs Growth Programme. The total value of the investment is EUR 738.375, with EUR 420.000 nonrefundable.

Back in 2018, Allevo submitted the grant application and partnered with Bakken & Bæck, a Norway based development studio, to develop an application that offers financial operations “as a service” to SMEs. Part of the project submitted was financed, namely the experimental development of the application. Therefore, as of November 1st 2019 the teams of both companies started working together to develop the application imagined in the business plan submitted back in 2018. The implementation of the project is almost over, with an end date of November 30th 2021.

As with any similar project, both teams encountered obstacles impossible to have been foreseen upfront, the most important being a series of external factors that impacted the progress of the project. Although it might have been expected that the global pandemic spread in March 2020 to have seriously impacted the project plan, it resulted in minimal changes on the two teams and on the way in which they interacted. As a lesson learned, which might be of help to other companies who plan to access this type of financing in the future, there are listed a couple of factors below that drove delays in the activity plan or changes to the scope of the project. This lesson learned is a collateral result of the project.

- The team was planned to be allocated full time to the project. However, when senior members of the team were unavailable, they were replaced by juniors, who have lower efficiency in completing tasks. This was a first source of delays, and it was not possible to compensate as the project went on. We recommend that HR effort is estimated with a margin that can accommodate this type of situation.

- Allevo and Bakken & Bæck teams defined back in 2018 the terms of the partnership agreement and drafted high-level activities each team was supposed to cover. When the project was financed and launched, the teams started a more complex analysis of the scope of the project and deliverables of each team. Unfortunately, some activities which were taken from the scope of Bakken & Bæck team and allocated to Allevo team, were not financed. We recommend special care to budget allocation for each activity, to avoid similar bottlenecks.

- The format of the annual financial report is updated in Romania at least twice a year. This uncovered the need to implement a sufficiently flexible annual report format, to accommodate similar future changes. Because this fact was neglected in the estimation drafted back in 2018, this project change now remains an activity that lacks financing. We recommend budgeting for unplanned changes.

The Whizzer application

The application helps SME business owners who lack an in depth financial background, who do not have an internal CFO role to rely on and who cannot afford to invest in big tech financial operations solutions. Such an entrepreneur usually leads a complex enough business from an operations perspective to need automation and integration of available financial data sources.

Almost any SME interacts with: 1/ partner banks, which offer easy remote access to accounts via mobile or internet banking applications; 2/ the accountant or accounting firm, if this service is outsourced, which usually provides balance sheets on the 25th of each month.

The Whizzer application is a financial reporting tool which includes a dashboard with up to date information that a business person can understand. This application is complementary to existing accounting applications and mobile or internet banking apps provided by banks. This is an application that enriches financial information available in banks and accounting, to show what the business looks like at a certain point in time.

Taking into account that over the past 40 years accounting systems have not undergone significant change, it is high time an entrepreneur had real-time access to critical information about his own business. Quick answers to questions like: what are the results of a certain period, what are the payments due over the next 2 weeks, what cost has been incurred by certain activities, what is due to be received. All these are questions that are supposed to have an instant response.

With Whizzer, SMEs centralize common financial flows and get up to date information about: balance sheet, salary payments, invoicing, cashflow, accounts payable and receivable. The application can be hosted in cloud, and Allevo is looking for a partner open to hosting Whizzer to offer its functionality as a service to SMEs. The partner can be: a bank, a local clearing house, an accounting company, or even an ambitious fintech.

Main functionality

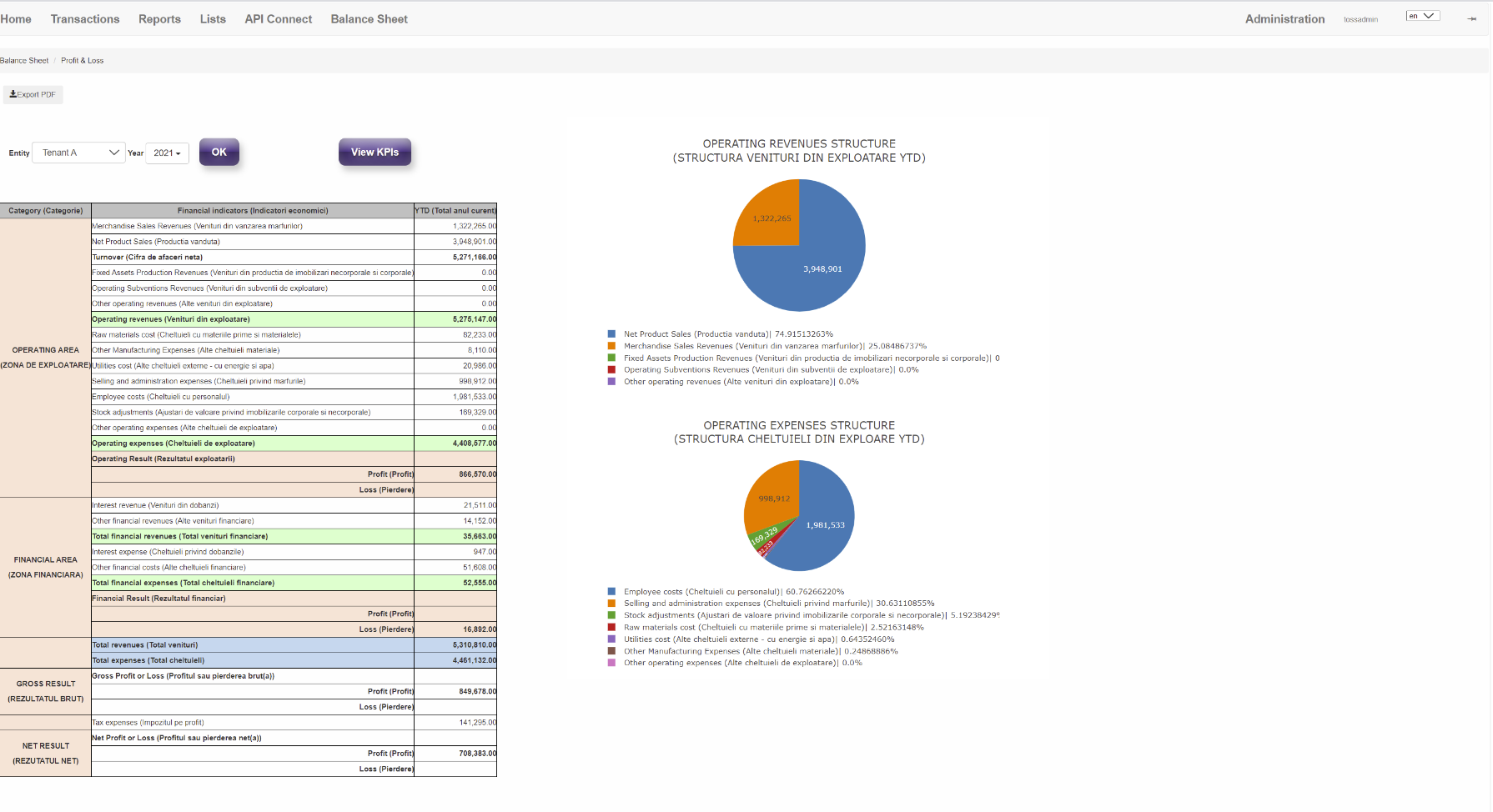

The application takes data from the annual financial report, either by manual data entry or by import. Each element is labelled both in Romanian and English, to facilitate an easy conversation with potential foreign investors. Information about indicators, revenue categories and expenses are shown both as numbers and in a visual form, to ease the quantification of data.

The application can connect to banks via API interfaces to retrieve bank statements, the only issue being that banks in Romania do not yet provide this type of data to business customers via APIs. Statements are currently only available as various types of files, available for download in internet banking applications. And they usually require manual download. As a result, statements can be imported in the application, from each partner bank, for each open account.

Bakken & Bæck implemented a reconciliation algorithm between data available in the bank statement and incoming or outgoing payments. This creates a link between what has been paid or cashed in, and what is due to be paid or cashed. This allows the application to generate an accounts payable & accounts receivable report that shows the evolution of incoming and outgoing payments.

The application allows the import of invoices received and issued. These are then used as a source of data to be checked against incoming and outgoing payments, and allows the generation of the cashflow report, including forecasted cashflow. In this way an SME can very easily make decisions and answer day to day questions like: do I have sufficient money to pay salaries? Should I negotiate early payment of an invoice, to be able to pay my debt? Do I need a loam? Can I afford planned expenses for the following month?.

All these results are to be published under a GPL v3 open source license on Github, and will be accessible on Github or via the fintp.org portal.

The application is available within Allevo as beta version for a potential demo – please reach out if interested.