Our second day at Money20/20 Europe was marked by a lot of optimism, energy and desire to make things better, as talks focused once again on collaboration, partnership and innovation, with a particular accent on user experience (UX), APIs, blockchain and PSD2.

Under the magic wand of Pat Patel, Content Director for Money 20/20 (Europe and Asia), the conference agenda was carefully anchored around 6 “theoretically simple things” (as he called them): why consumers and businesses spend, manage, save, borrow, share, and protect money.

Newcomers in the financial industry were advised by Jim McCarthy, EVP at Visa, to understand their core assets, as well as things others can provide: “you have to run at the speed of software and keep up with the pace of change that’s really driving this world as we know it. You need to learn to partner and figure out who can help you get there faster.”

Another helping hand came from Philippe Vallée, CEO at Gemalto NV, who underlined the need for everyone to be curious, agile and adaptive, since this ecosystem is evolving fast and it’s extremely important to stay open, tuned and understand the trends. He further defined the importance of collaboration in this industry as “a good recipe not to stay on the side of the road, by being influenced, challenged, in particular by millennials, young kids who have a lot of ideas about how to change, and therefor, a good way to stay in the race is to be open and listen to what’s happening around.”

Giulio Montemagno, General Manager at Amazon Pay (Europe), further stressed the importance of collaboration, as “innovation is very rarely acceded by one single company”. On the controversial topic of the changes we’re all facing, his point of view was extremely elegant and in line with our own beliefs, here at Allevo: “since the only constant is change, we need to constantly adapt, to lean into the future, to adapt our technologies, our services, and our businesses to the ever-changing condition.”

“At the end of the day, it’s all about humans. Software doesn’t meet each other magically.”

– Jim McCarthy, EVP, VISA –

on partnerships and collaboration

Gemma Godfrey, CEO at MOOLA: “The world has changed, the balance of power has shifted, that old way of working, of being locked in a room in an ivory tower thinking up the next idea to sell, is dead.”

Back to Philippe Vallée (Gemalto), this time on the crossroad between UX and security compliance: “Different technologies are coming into play to increase user experience, to make it more freed, less clingy, while not compromising with the security […] This industry is facing a lot of regulation, specifications to meet, to be compliant with, and we shouldn’t forget when designing a new product or launching new services about this sort of compliance we need to respect. The agility today and the technology we can use can help us comply without compromising the user friendliness.”

Customer Loyalty Has Changed:

P.V. (Gemalto): “I’m sure that FinTechs will sooner or later face the same challenge. This is why, as an industry, we need to keep enhancing the user experience, without compromising security. We need to offer at the same time loyalty AND trust.”

Last, but not least, on the topic of open banking and PSD2, there was an interesting debate on… wait for it… PSD3! Under the motto “This time we mean business”, UL Principal Consultant, Xiaodong Guo, talked about the inevitable – and fast approaching – bank (r)evolution. Talks further revolved around open banking as a concept, and PSD2 as a small part of it, the need for regulation in this field, as well as the benefits for the end user.

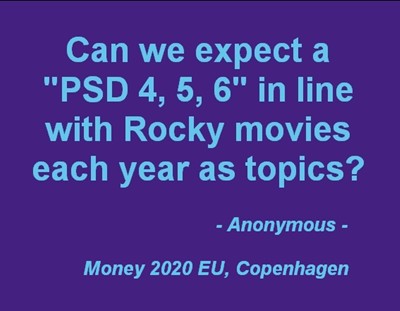

We must insist on the huge uncertainty still revolving around this directive, where banks still ask solution providers: “You are the experts, you tell us what to do!” This is why, in an on-site poll asking participants whether PSD2 is creating more questions than it answers, a vast majority agreed that it does, while a particular (and anonymous) intervention was greeted with giggles.

We’re sharing it with you below, to end our second day report on the fun side: