Experts agree that in order to minimize the amount of work involved, it is good practice to carry out bank reconciliations on a daily basis, preferably assisted by specialized accounting software.

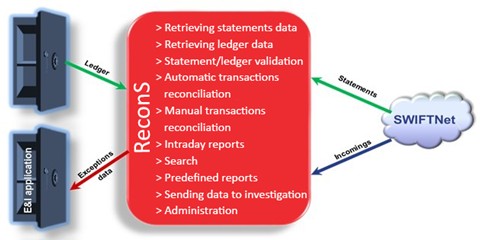

FinTP’s ReconS feature provides real-time automated / manual reconciliation of incoming or outgoing payments with bank statements. Not only does it lead to more timely reactions to risks, thus contributing to standards improvement and manual effort reduction, but it also helps reduce the overall cost.

In fact, here is a brief list of characteristics, which we may further expand upon request, especially since ReconS is also available as a stand-alone product:

|

1. Ledger vs. Statement Reconciliation (NOSTRO)

ReconS reconciles NOSTRO SWIFT statement and general ledger (GL) items and provides “offered”, “suspended” and “confirmed” matching functionality depending on the percentage of the satisfied criteria.

High-quality matches can be confirmed automatically, while others are submitted to the operators, in order to make an informed decision (suspend, confirm or unmatch).

2. Payments vs. Statement Reconciliation (VOSTRO)

ReconS also compares SWIFT payments vs. VOSTRO statements reconciliation, offering the possibility to check the quality of the statements delivered to customers.

3. Automatic or User-driven Reconciliation

The app automatically prompts operators to confirm the reconciled transactions based on a combination of criteria defined when configuring the system.

Certain confirmed transactions from the current session or from the transactions history can be reactivated in order to be corrected.

4. Intraday Liquidity Reports

ReconS monitors the balance in NOSTRO/VOSTRO accounts and checks whether the limit exposure is exceeded for accounts, accounts groups, or currency types, using a variety of SWIFT messages.

It also makes forecasts based on the information in: the statements received from SWIFT, NOSTRO accounts transactions, and total amount of the payments about to be performed, reporting the status of the unreconciled transactions, consolidated on various currencies.

5. Investigation Features

Identifying the unreconciled transactions, ReconS offers the possibility to either suspend them for further investigations, or to insert an explanation and to print these matches.

It also gives the user the possibility to point out or assign (in electronic format) the unconfirmed transactions to other applications/departments or users for further investigation.

6. Rich Set of Reporting Templates for a Thorough Operations Control

Reports in ReconS can be generated based on various criteria, like account, currency, bank, currency date, or booking date, as well as a combination of these.

Besides reporting the available and booking balance separately on each account and globally on all accounts, the app also reports the manually confirmed matches, detecting the ones that were incorrectly confirmed with a different currency date.

Other predefined reports are available, along with the possibility to define customized reports for monitoring the user activity in order to optimize operations.

Why ReconS?

First of all, it addresses the problem of identifying and managing the exceptions (reconciliation problems that cannot be automatically solved using the defined business rules), highlighting the data that has failed to be automatically matched and proposing solutions to facilitate the operator’s decision.

| Incorrect SWIFT messages are quickly detected for immediate clarification and the amounts under investigation are kept under control in order to promptly solve them. At the same time, the balance is accurately established according to the currency date and incorrect registrations are eliminated. |

Last but not least, endowed with a powerful reporting and query engine, ReconS allows users to extract any information in order to run a comprehensive analysis of accounts and matching information, by means of a user-friendly graphical interface.

This multi-platform product works both in Unix/Linux and Windows environments, offering connectors for SWIFT interfaces and GL applications, and supporting both SWIFT FIN and ISO 20022 message standards, as well as various data sources and formats.