Certain crimes generate large amounts of “dirty” money that needs to be cleaned to seem derived from legal activities, so that banks and other financial institutions would deal with it without suspicion.

(Anti) Money Laundering Timelapse

Believe it or not, money laundering regulations date back to 2000 BC, when Chinese merchants used to hide their wealth from rulers by investing it in remote provinces or even outside China.

It didn’t take long for real offshore banking and tax evasion to develop, since many states decided to impose rules for confiscating the citizens’ wealth. One of the most notable informal value transfer systems still in use today is that of hawala, especially in the Middle East and North Africa.

The 9/11 attacks assigned new priorities for money laundering laws that would combat terrorism financing and, starting in 2002, governments around the world increased surveillance and monitoring of financial transactions.

The latest iteration of the EU’s anti-money laundering directive (AMLD IV) became effective June 25, 2015, with a 2-year window for implementation, in an attempt to get more in line with US requirements, since the lack of harmonization between these two affected financial institutions operating in both jurisdictions.

Who Should Comply and How?

Current AML regulations apply to all credit and financial institutions, private pension funds, casinos, auditors and, under certain conditions, to public notaries, lawyers, service providers, real estate agents, as well as other natural or legal persons trading goods or services for total cash transactions of minimum 15 000 EUR.

Starting with AMLD IV, more public officials are brought within the scope of the directive, as well as the entire gambling sector. Moreover, EU member states have to establish new registries of “ultimate beneficiaries”, whilst the payment threshold is lowered to 10 000 EUR.

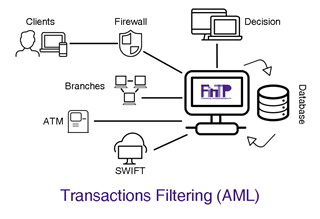

The broad range of risks has to be tackled efficiently by incorporating a special filtering function in the transaction processing solution, and we guarantee you that the most cost-effective software of this kind is the open-source FinTP, whose AML filtering feature has received the FinMedia e-Support Award in 2010.

Take a Peek at What We Have to Offer

The Transactions Filtering feature of FinTP identifies the inter-banking payments that present a high CFT (Combating the Financing of Terrorism) infringement risk, offering the possibility to analyze them and to make the appropriate decision of authorizing or rejecting the payment, before the actual funds transfer.

The application provides message filtering with detection of possible money laundering transactions, for both high and low value payments for various types of instructions, such as:

- Payment instructions received/sent via SWIFT network: MT103, MT103+, MT202COV

- Payment instructions received/sent in relation with an automated clearing house, like SEPA standard format (pacs.008, pacs.004), or proprietary message structures (CoreBulkcreditTransfer)

- Other instructions corresponding to financial instruments like cheques, bills, promissory notes.

Besides preventing the risk of financing terrorist activities, this feature also assists banks in meeting the regulatory requirements of both local and international legislation related to the sensitive compliance aspect, while compiling different types of sanctions lists and offering a complete set of reports and statistics.

The message filtering functionality works online, in real time, against over 20 black lists, including official international sanctions lists, as well as the bank’s internal lists. Filtering lists are chosen and uploaded by the user, with automated or manual upgrade or update options, completely independent from the solution provider.

Please know that we’re here to help you comply and we strongly believe that you too should benefit right away from enhanced protection of fund transfers!