It was also a get-to-know-each-other event, with us looking to understand what MFIs in Romania are looking for from a solution provider and MFIs interested to find out how Allevo can help. Participants said MFIs are looking for something new to be implemented on the Romanian market, something that can be truly useful for both the institutions and their customers. And we were happy to hear they believe Allevo can help them be more creative and even surprise their customers with new services.

The workshop also enjoyed the presence of Dutch consultant Ruud van der Horst, whose presentation took a closer look at microfinance from different perspectives: credits, deposits, money transfers and insurance, also showing them by comparison between MFI and normal. He then presented the Musoni case study, a Dutch microfinancing institution which gives loans using the MPESA service of Safaricom in Kenya. Musoni has built a “battle tested” system with Allevo’s solution in the middle as traffic agent and law enforcer, which facilitates very controlled straight through processing.

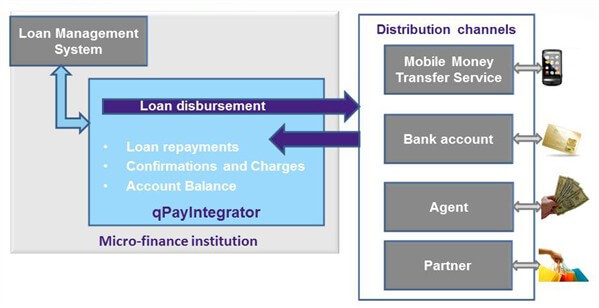

Like shown in the picture below, Allevo’s solution for MFIs enables integration; flow automation; disbursement management; processing and reconciliation for disbursements and loan repayments, system confirmations, system charges and account balance; monitoring, investigation and alerts; advanced reports.

And here’s a short movie that can help you better understand how it works.

Don’t forget, if you are a Micro-Finance Institution in search for a solution to optimize your operations and you missed our workshop this week, just contact us.