LUCKILY, not all sessions at Sibos were about regulation (not to say… boring). A great deal of these were focused on creating affordable financial services for masses, on finding elegant solutions for banking the unbanked, on doing banking as a means of doing good – beautifully paradigmed by Innotribe as Banks for a better world, on mobile payments & other topics in this direction.

Sibos is building up a tradition of bringing distinguished keynote speakers to end the event in style, so at the closing plenaries I’ve attended so far, I’ve had the privilege of hearing Don Tapscott talking about the new era of transparency, Guy Kawasaki about the meaning of innovation, Paul Saffo about the future of financial services & Brett King about Bank 2.0. This time around, the closing plenary brought somebody who did not need any introductions or set the scenes, professor Muhammad Yunus, a remarkable personality who delivered the most inspiring speech I’ve ever heard. For those of you who did not attend Sibos, you can have a look of his 2012 TEDx Vienna talk. Truly inspirational. How money making business is just the means, whereas social business is the end.

In short, this man has created a business, a social business, for every problem he stumbled upon in the Bangladeshi society – poverty (Grameen Bank), illiteracy (Grameen Foundation Scholarship Program), lack of electricity (Grameen Shakti), lack of nutrients (Grameen Danone), lack of cell phones (Grameen Phone) etc. For each of these he has created a self-sustaining business. It all started with the Nobel prize winner Grameen Bank, a non-profit institution known to do banking for the poor & owned by the borrowers.

He made a connection to today’s reality, saying that the young generation of today is the most powerful in the history of humanity because of the tech they’re born with. He said that tech will demolish classrooms & universities and he made a link to the crisis the financial system has been confronted with for years now – the deeper the crisis, the more the opportunity.

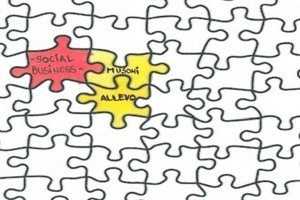

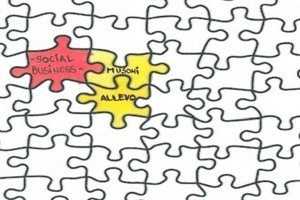

All this made me all of a sudden realize, one of our most interesting customers, Musoni, who as a business does microfinancing in Kenya & Uganda and are looking forward to expanding to a few other African countries, such as Ghana over the following years, is providing just that – an affordable way of providing financial services for the masses. Which in essence improves the quality of life, offers the possibility of creating a self-sustaining business for small merchants, even though it’s not a truly social business as it’s a for profit institution. Unfortunately, they were not able to join us this year for our Agile Financial Inclusion session, where their story could have been laid out as an example for others to follow. Their core systems rely 100% on our solution for processing financial transactions, thus Allevo is a piece of the puzzle in this story of doing good. And it made me feel good to see how we are part of it, because who does not want to be part of something big, of a story similar to the one told by professor Yunus?

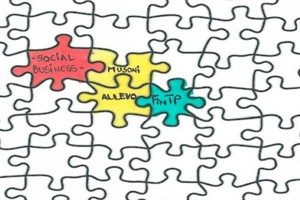

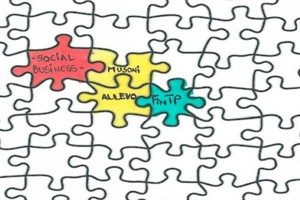

Jumping from microfinancing to our main focus of these days, we are doing something highly disruptive to the banking industry, which is a drastic change in our business model, stepping away from the traditional habits of owning and controlling and turning to open & freely distributed solutions. This is a big cultural leap ahead and a complete change in values which affects us, as well as our customers. This is all about sharing and creating a collaborative environment where ideas are born & nurtured. The starting point is FinTP, the single open solution that processes financial information.

Why are we taking this path?

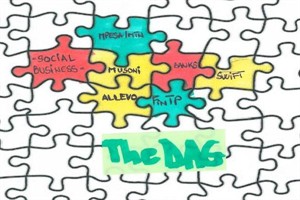

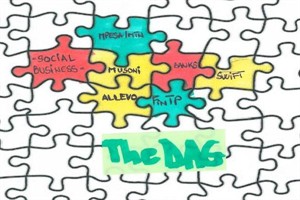

I’m going to quote both Yobie, as heard in one of my most favorite Sibos sessions, the Digital Asset Grid (DAG), & Mark Pesce, one of Corina & I’s co-panelists in the Hyper Economies session. Yobie said the banking industry is slowly being dis-intermediated by lots of small start-ups who provide financial services to people, services banks weren’t able to come up with so far. Today, this is no longer only about banking, it’s also about commerce and banks can no longer afford to live on AML, KYC & I dare add the generic concept of payments, as these are all going to get highly commoditized. Banks need to change their value proposition to customers, otherwise they face the danger of ending up in the business of clearing money for more agile players. Mark Pesce suggested a way to do this and this is the dis-aggregation of services, which means breaking these into small components which target specific needs and which can be recomposed on a per needed basis.

And what does that have to do with Allevo & solutions for processing data? In a moment.

I mentioned the DAG. It basically is a peer to peer platform for sharing data between people, businesses & devices. It means creating a digital map of data (called digital assets) for which location, permissions, rights & trust are key elements. It is centered around the empowered customer who is the one who decides what pieces of information he/she wants to share & with whom. This is something larger than Facebook, it will do for data (to quote Yobie again) what swift has done for payments.

Key about this whole infrastructure is that it needs to scale, it needs to be designed to provide connectivity for millions of end-points in the grid; and it needs to be capable to provide proper services to these nodes – things like search capabilities, matching of offer & demand, targeted suggestions and so on. Which is why apps and services of the future (of the very near future) need to be designed in a plug & play manner. Businesses that want to be part of this new ecosystem need to open up a way for other businesses to interact with their core-competence. Plug & play. APIs. Lego blocks, as mentioned by Mark Pesce.

All these things mentioned above, social business, banks, FinTP are connected together and each of them can make a piece of the huge DAG puzzle. Note that the picture below is only a small part of the bigger whole. All those empty puzzle tiles exist and need to come together to create the grid.

We at Allevo are already going into this direction, being one of the companies who provide freely distributed open solutions. Nothing’s special about this approach except for the fact that we will offer a full solution for processing any form of financial data, distributed under free & open source license. This is big. It means that anyone who wants to create a form of I’ll generically call it a bank, can start one based on this open solution. Anyone who wants to start an MFI in an underdeveloped country can do so by using our open solution. Open means in a few words: download, install, test & evaluate, present prototype to the board & deploy the solution if it resolves the business need. And this solution is a piece of the puzzle in the futuristic DAG model.

How is an open solution going to help financial institutions to be more agile and be able to use the full potential of the DAG? Customers of banks simply don’t care about the pipes running in the back-offices of these institutions. They are happy if the service they get & the way they get it is relevant & convenient enough. Then what would happen if these back-end systems would actually be THE SAME? In all banks; in all financial institutions. We encourage FIs to start collaborating at plumbing level, to create a standardized way in which things are done at IT level & focus on delivering services perceived of value by the people & merchants they serve. Open solutions are a step forward into this direction.

I’m keen to hear the opinions of & start a discussion with anyone who attended these sessions mentioned above or who is a follower of our blog.