Solutions for microfinance

Error: Contact form not found.

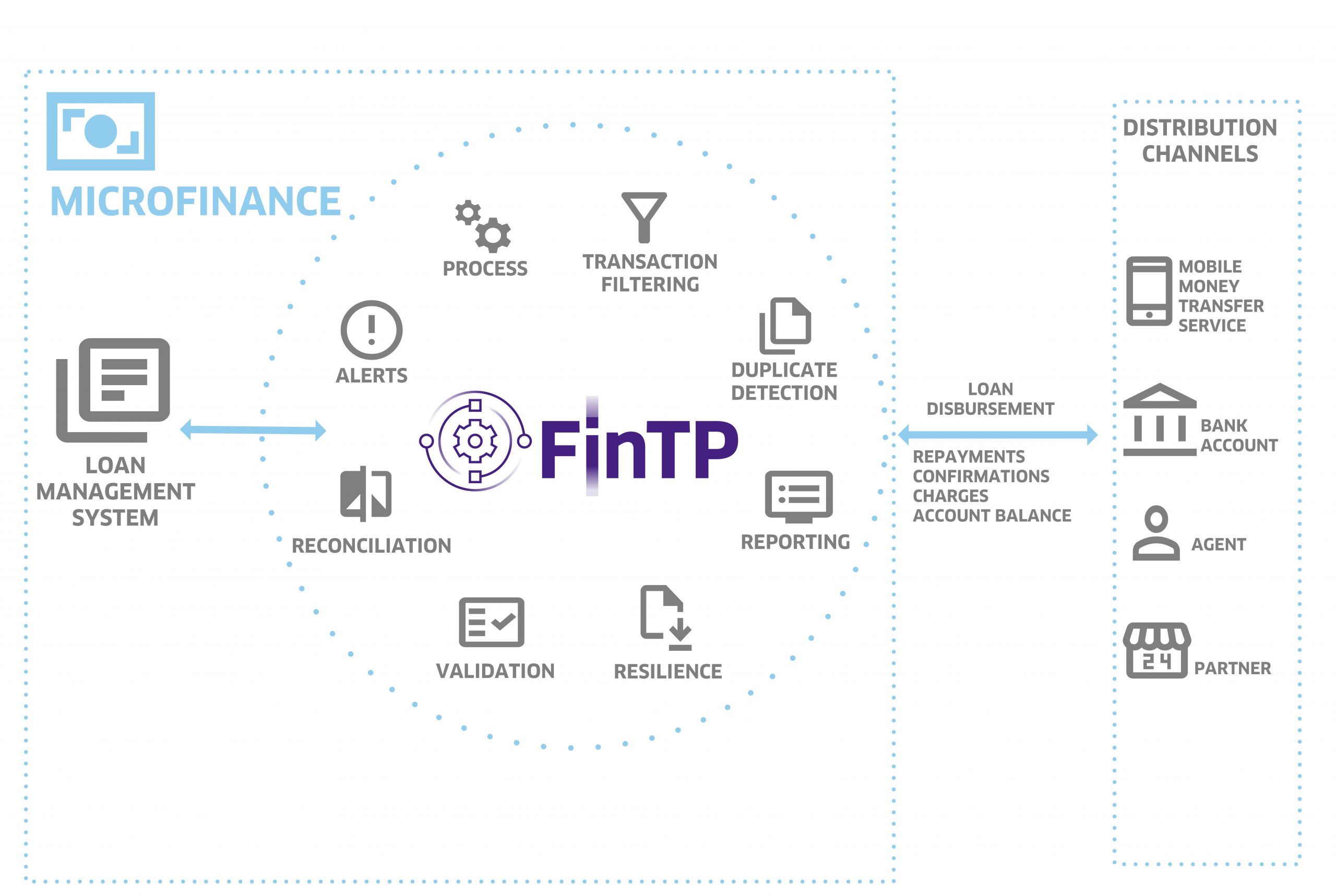

Flow automation and integration

Process financial transactions and automate business flows, ensuring resilience, persistance. Native ISO20022 support. Single window for managing loan disbursements and repayments.

Compliance

To local or international standards and regulatory requirements for the financial industry.

End-to-end Interoperability

Between loan management and accounting applications, mobile payment operators, banks. Multi mobile transfer operator distribution channels, multi-country and multi-currency capabilities.

Operational features

Detection, disbursement management, system confirmations and charges, validation and filtering, alerts, amount limits, eArchive.

Reporting

Cash reporting, account balance, monitoring, investigation, custom reports.

Financial transactions

Disbursement Loan repayment Confirmation ChargeScenario

FinTPm retrieves loan disbursements from MFI internal systems, converts them into the ISO 20022 internal format and prepares them to be sent to the intended distribution channel (M-PESA, MTN) in the specific format. It provides support for loan management applications, loan disbursement and repayments. It integrates mobile and bank payments, and as such provides working capital management. Multi-MMT and multi country functionality is supported.

Here is a short video featuring a use case.

High-level architecture