The yearly Allevo User Group event no 33 went online, for obvious reasons. We were happy though to be able to see our long time customers and partners and show them a wrap-up of 2020, new features of FinTP, a demo of FinTPc, highlights of the Whizzer project, and new features under way: Instant Payments, CBPR+, TARGET2 / T2S, standards update etc.

Allevo was featured in the December 2020 edition of the Magurele Science Park magazine with a call to action to local academia to get involved and help test and validate the Whizzer project.

Allevo, with the support of a grant from Iceland, Liechtenstein and Norway through the EEA and Norwegian Financial Mechanisms 2014-2021, in the frame of the “SMEs Growth Romania” programme, is half-way with the Whizzer project, as per the 2018/115906 contract.

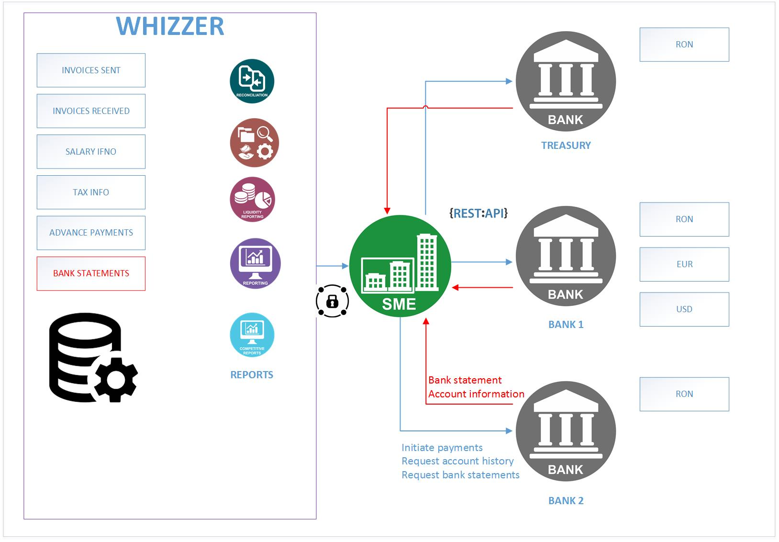

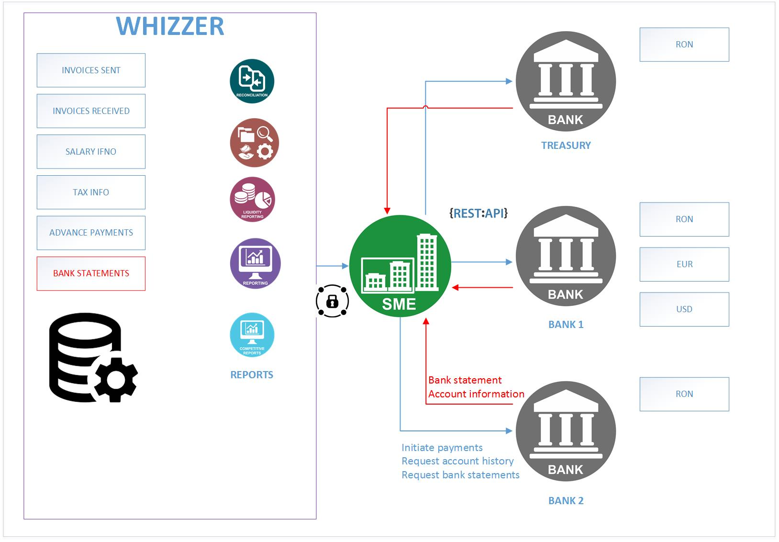

The project is implemented in Bucharest, has an end date of 30 November 2021 and a total value of EUR 738.375, out of which EUR 420.000 non-refundable grant. The Whizzer project is aimed to create an open source software solution that offers financial operations as a service to SMEs, to help them automate and centralize common financial flows, at a very low cost: balance sheet, salary payments, invoicing, money flow automation, accounts payable and receivable, cash reporting. Target group includes banks, financial service providers and SMEs across Europe, with focus on SMEs, in terms of technical harmonization and communication on top of a well-built open banking layer.

The project includes an artificial intelligence component that ensures a detailed analysis of processed data. This component is designed and developed by Bakken & Bæck AS, a company with background and experience in building AI capability. This partnership is possible through the bilateral relationships between Norway and Romania, promoted by the financing program.

The project aims to increase the rate of financial inclusion, by addressing the ecosystem (banks, financial service providers and SMEs across Europe), with focus on SMEs, in terms of technical harmonization and communication on top of a well-built open banking layer.

What has Allevo achieved so far? We worked to define the business and technical requirements of the application, drafting specifications, and the architecture and design documentation. The project is running according to plan, with possible delay in finalizing the analysis phase, due to difference between the estimation between when we applied for the grant (Oct 2018) and the actual implementation (Dec 2020).

Features defined so far include:

- Product positioning, software as a service requirements, security, performance and product perspectives

- The main building blocks: admin zone, interfaces, transactions processing engine, reporting, audit trails

- Multitenancy

- Financial messages, data structures and message queues

- Business areas: payments, invoices, statements

- User actions

- Entities

- Reconciliation rules

- Processing stages: fetch, format, store, route, publish

- Accounts payable and accounts receivable: automatic and manual reconciliation options. Criteria: debit transactions with invoices received from suppliers, credit statement with issued invoices, debit statement with payments. For this feature our partner Bakken and Bæck helps with building an algorithm that learns from the data processed by the app

- Balance sheet: P&L Report, Balance Sheet Report

- Cash Reporting: liquidity report

Aside from all these, Allevo also worked on developing the software application that implements these requirements, and is building test scenarios and user stories for verification and validation purposes. Other activities that are co-financed include: project management, communication, software and hardware environment setup, and deployment and configuration of the final app on the existing environment. The deployment phase has not been started yet, it is planned for the final 6 months of the project.

We so far sent in three Interim Reports and received the co-financing amounts in a timely manner.

We are interested in feedback for the above mentioned features, so that we can develop the product to match expectations of the SMEs in the market. If there is a feature the management of financial department of your SME would like us to add, please reach out and send your feedback!

https://allevo.ro – https://fintp.org

SMEs Growth Programme: https://www.innovasjonnorge.no/smesgrowthromania

December 2020 we finalized tests to attest FinTP as ISO 20022 CBPR+ (Cross-border Payments and Reporting Plus) Ready. Our team successfully passed the self-attesting for FinTP’s readiness. Details about Allevo and FinTP are available on SWIFT.com.

FinTP is ‘ISO 20022 CBPR+ ready’

The successful self-attestation of FinTP is now included in SWIFT communications to the SWIFT community of 11,800 banks.

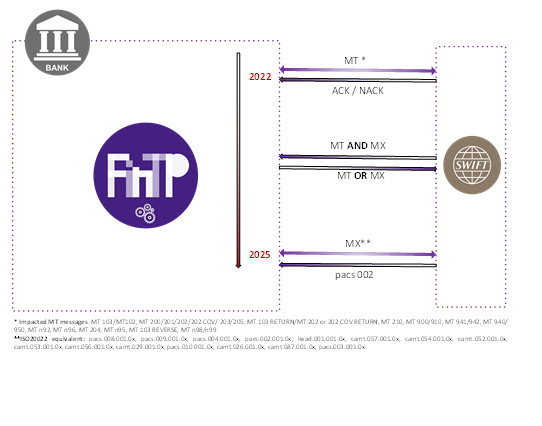

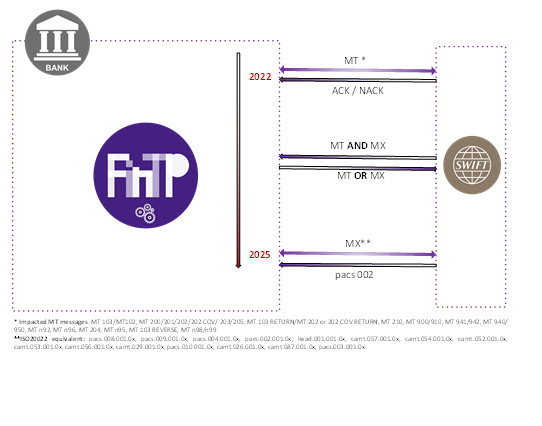

One of SWIFT’s main goals now is to make ISO 20022 global adoption a success. Migration to this standard has been made mandatory, and a detailed action plan, due to end 2025 is now available. Briefly, mandatory milestones are set as follows:

- 21 Nov 2022 – all participants must receive ISO 20022 messages (migration from MT categ. 1, 2, 9)

- Nov 2025 – all participants must send and receive ISO 20022 messages

A coexistence period is available for sending ISO 20022 messages, between Nov 2022 and Nov 2025.

Allevo extended FinTP with a feature meant to accommodate this requirement, FinTP-CB.

Instructions processed:

- Customer Credit Transfer (MT103) – pacs.008

- Payment Return (Return-uri de MT103, MT202, MT202COV) – pacs.004

- Financial Institution Credit Transfer (CORE and COV) (MT202, MT202COV) – pacs.009

- Notice to Receive (MT210) – camt.057

- Business ACK / NACK – pacs.002

- Business Application Header (BAH) – head.001.001.0x

- Statements (MT940, MT950) – camt.053

- Confirmation of Debit / Credit (MT900, MT910) – camt.054

- Balance Report si Interim Transaction Report (MT941, MT942) – camt.052

Please reach out if you’d like to learn how FinTP can help you achieve ISO 20022 compliance and how this migration can be as seamless as possible.