(RO) Allevo si Bakken & Bæck au finalizat proiectul Whizzer

The project benefits from a EEA & Norway Grants grant investment operated by Innovation Norway, SMEs Growth Programme. The total value of the investment is EUR 738.375, with EUR 420.000 EUR nonrefundable.

As part of the Whizzer Project, Allevo and Bakken & Baeck published a Whitepaper Report with the support of Fintech Finance. Please see our paper here:

The Whizzer project benefits from a EEA & Norway Grants grant investment from Iceland, Liechtenstein and Norway through the EEA and Norwegian Financial Mechanisms 2014-2021, in the frame of the Programme “SMEs Growth Romania”, operated by Innovation Norway. The total value of the investment is EUR 738.375, with EUR 420.000 EUR nonrefundable, as per the 2018/115906 contract.

The yearly Allevo User Group event no 34 was organized on November 16th 2021. We ran a first demo of the application developed as part of the Whizzer project.

Context

Allevo and Bakken & Bæck are almost finalizing the implementation of the Whizzer project. The project benefits from an EEA & Norway Grants grant investment operated by Innovation Norway, SMEs Growth Programme. The total value of the investment is EUR 738.375, with EUR 420.000 nonrefundable.

Back in 2018, Allevo submitted the grant application and partnered with Bakken & Bæck, a Norway based development studio, to develop an application that offers financial operations “as a service” to SMEs. Part of the project submitted was financed, namely the experimental development of the application. Therefore, as of November 1st 2019 the teams of both companies started working together to develop the application imagined in the business plan submitted back in 2018. The implementation of the project is almost over, with an end date of November 30th 2021.

As with any similar project, both teams encountered obstacles impossible to have been foreseen upfront, the most important being a series of external factors that impacted the progress of the project. Although it might have been expected that the global pandemic spread in March 2020 to have seriously impacted the project plan, it resulted in minimal changes on the two teams and on the way in which they interacted. As a lesson learned, which might be of help to other companies who plan to access this type of financing in the future, there are listed a couple of factors below that drove delays in the activity plan or changes to the scope of the project. This lesson learned is a collateral result of the project.

The Whizzer application

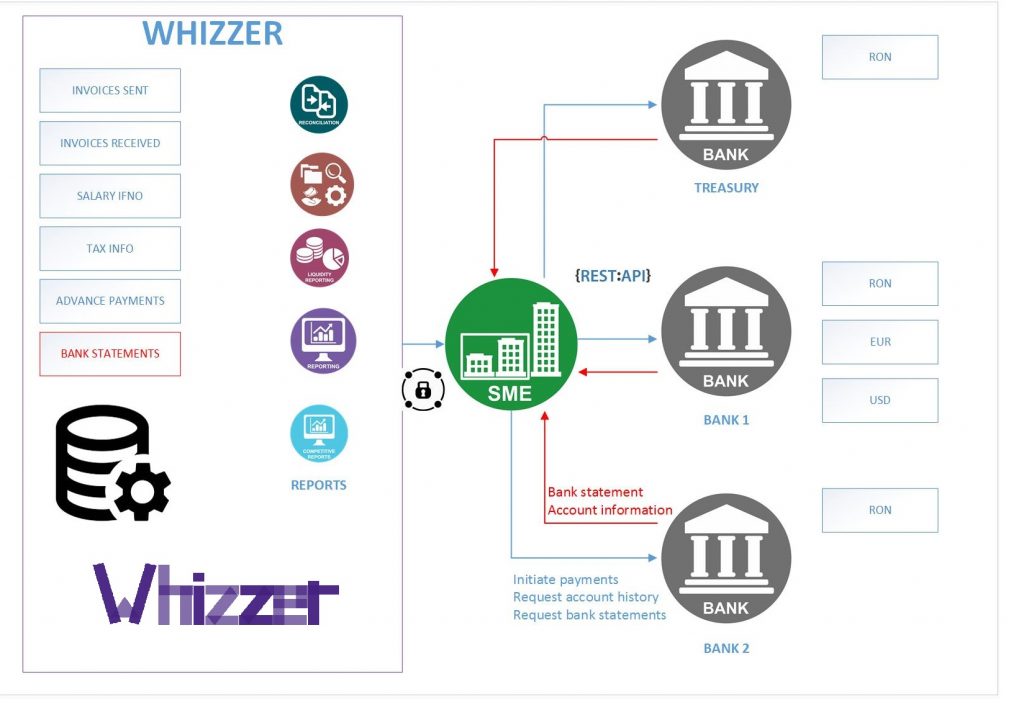

The application helps SME business owners who lack an in depth financial background, who do not have an internal CFO role to rely on and who cannot afford to invest in big tech financial operations solutions. Such an entrepreneur usually leads a complex enough business from an operations perspective to need automation and integration of available financial data sources.

Almost any SME interacts with: 1/ partner banks, which offer easy remote access to accounts via mobile or internet banking applications; 2/ the accountant or accounting firm, if this service is outsourced, which usually provides balance sheets on the 25th of each month.

The Whizzer application is a financial reporting tool which includes a dashboard with up to date information that a business person can understand. This application is complementary to existing accounting applications and mobile or internet banking apps provided by banks. This is an application that enriches financial information available in banks and accounting, to show what the business looks like at a certain point in time.

Taking into account that over the past 40 years accounting systems have not undergone significant change, it is high time an entrepreneur had real-time access to critical information about his own business. Quick answers to questions like: what are the results of a certain period, what are the payments due over the next 2 weeks, what cost has been incurred by certain activities, what is due to be received. All these are questions that are supposed to have an instant response.

With Whizzer, SMEs centralize common financial flows and get up to date information about: balance sheet, salary payments, invoicing, cashflow, accounts payable and receivable. The application can be hosted in cloud, and Allevo is looking for a partner open to hosting Whizzer to offer its functionality as a service to SMEs. The partner can be: a bank, a local clearing house, an accounting company, or even an ambitious fintech.

Main functionality

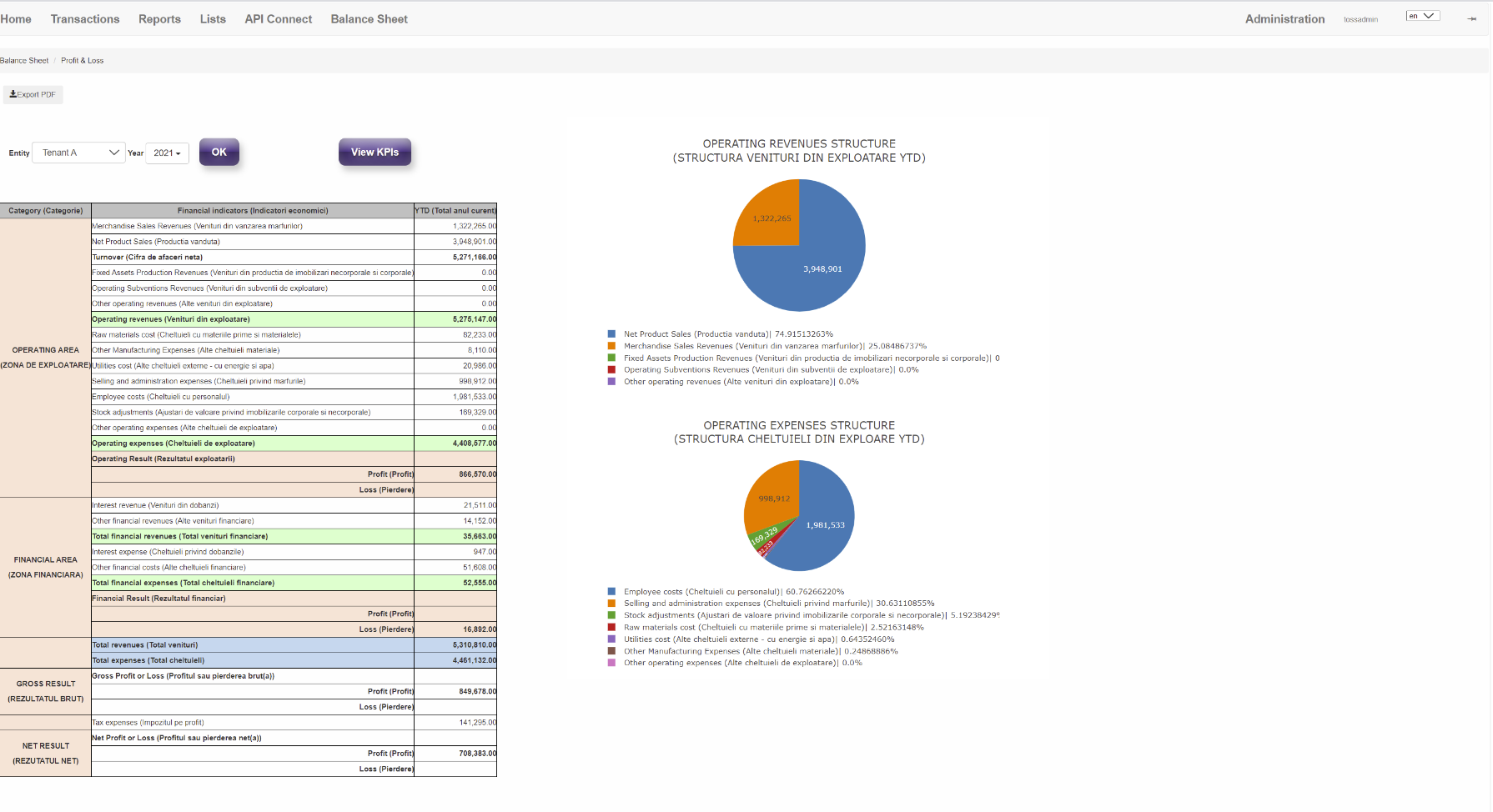

The application takes data from the annual financial report, either by manual data entry or by import. Each element is labelled both in Romanian and English, to facilitate an easy conversation with potential foreign investors. Information about indicators, revenue categories and expenses are shown both as numbers and in a visual form, to ease the quantification of data.

The application can connect to banks via API interfaces to retrieve bank statements, the only issue being that banks in Romania do not yet provide this type of data to business customers via APIs. Statements are currently only available as various types of files, available for download in internet banking applications. And they usually require manual download. As a result, statements can be imported in the application, from each partner bank, for each open account.

Bakken & Bæck implemented a reconciliation algorithm between data available in the bank statement and incoming or outgoing payments. This creates a link between what has been paid or cashed in, and what is due to be paid or cashed. This allows the application to generate an accounts payable & accounts receivable report that shows the evolution of incoming and outgoing payments.

The application allows the import of invoices received and issued. These are then used as a source of data to be checked against incoming and outgoing payments, and allows the generation of the cashflow report, including forecasted cashflow. In this way an SME can very easily make decisions and answer day to day questions like: do I have sufficient money to pay salaries? Should I negotiate early payment of an invoice, to be able to pay my debt? Do I need a loam? Can I afford planned expenses for the following month?.

All these results are to be published under a GPL v3 open source license on Github, and will be accessible on Github or via the fintp.org portal.

The application is available within Allevo as beta version for a potential demo – please reach out if interested.

As part of the series of wide dissemination events, episode 3 is organized with the kind support of Asociatia Trezorierilor din Romania.

With Whizzer, SMEs gain access to critical informations very fast and get a friendly outlook on statement and annual financial report data.

We implement Whizzer with the support of Innovation Norway Romania (SMEs Growth Romania program via EEA & Norway Grants) total value EUR 740k, non-refundable: EUR 420k.

Main result:

An open source application (GPL v3 license) which offers SMEs financial operations as a service. A complex reporting tool which presents information about: balance sheet, salary payments, invoices, financial flows, accounts payable/receivable, cashflow reporting and forecast. The application can be hosted in cloud by a datacenter or an AISP entity, which provides the service to SMEs.

Until 2023 (compared to 2018) we will also obtain:

4 permanent jobs: one analist, one developer, one tester, one system engineer

Estimated turnover growth 28%

Estimated profit growth 66%.

Allevo partnered with Bakken & Baeck, a Norwegian based software boutique. Whizzer is built for SMEs with complex enough business to require automation, and insufficient resources to invest in big tech solutions.

Bakken & Baeck helped develop a reconciliation algorithm, used both in cash reporting and forecast, and in the accounts payable/receivable functionalities.

Functionalities:

-Balance sheet report

-Financial forecast: liquidity or balance sheet

-Salary payments

-Invoice management

-Financial flow automation

Accounts payable and accounts receivable.

Allevo is launching a series of wide dissemination events. Episode 1 is here, courtesy of Magurele Science Park.

We implement the Whizzer project with the help of EEA & Norway Grants, as part of the “SMEs

We implement the Whizzer project with the help of EEA & Norway Grants, as part of the “SMEs

Growth Romania” program, operated by Innovation Norway Romania. The total nonrefundable value of the grant is EUR 420k. This money allows us to invest in developing an application aimed to help SMEs better manage their finances.

For this project, we partnered with Bakken & Bæck, a development studio based in Norway, to help us make sense of the data processed by our application. They helped us define a matching algorithm for transactions available in the application. This algorithm is useful for some of the reports delivered by the application to its users: accounts payable and accounts receivable and cashflow reporting and forecasting.

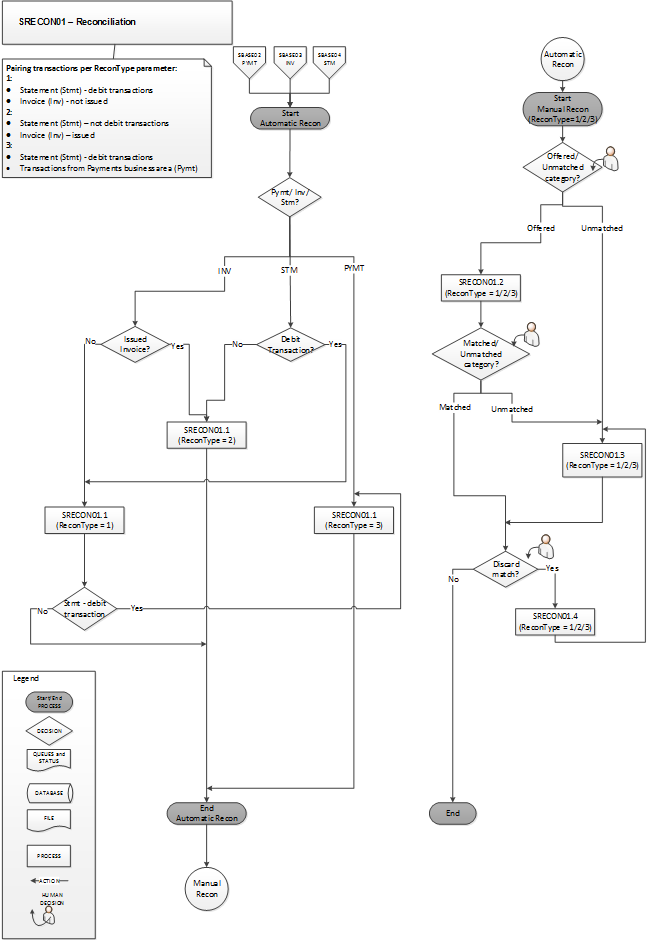

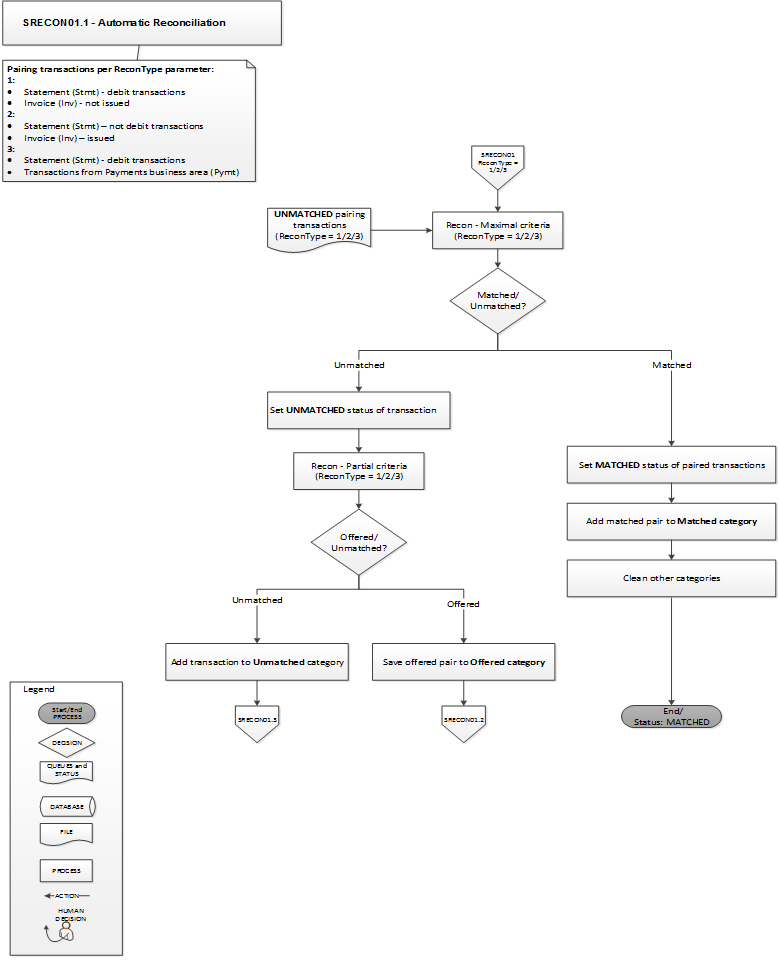

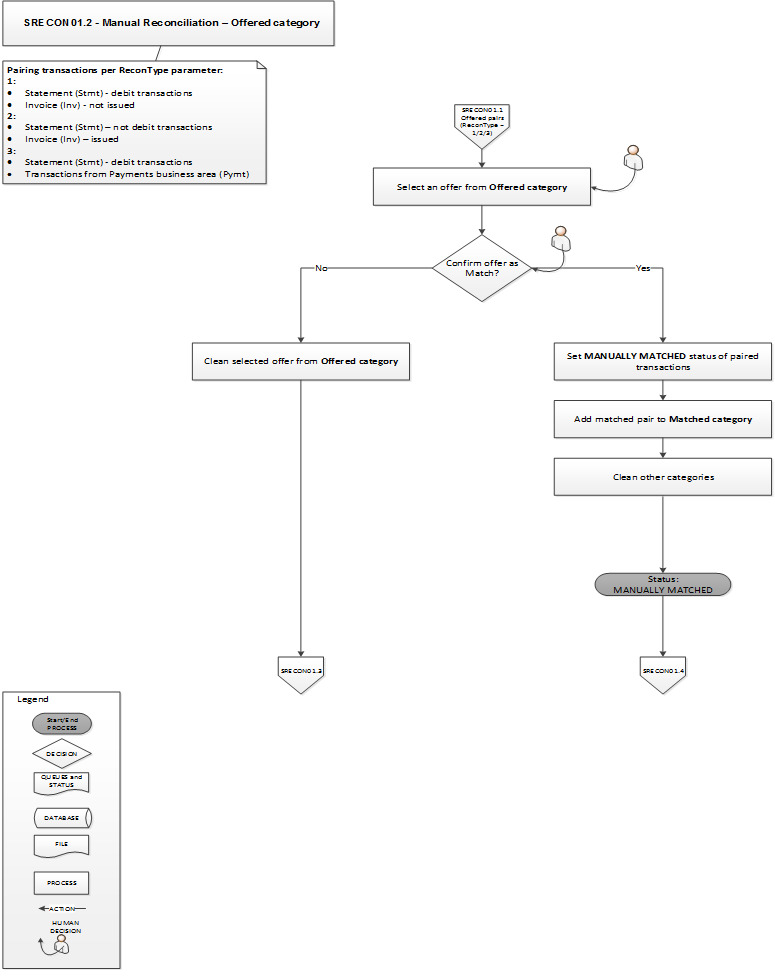

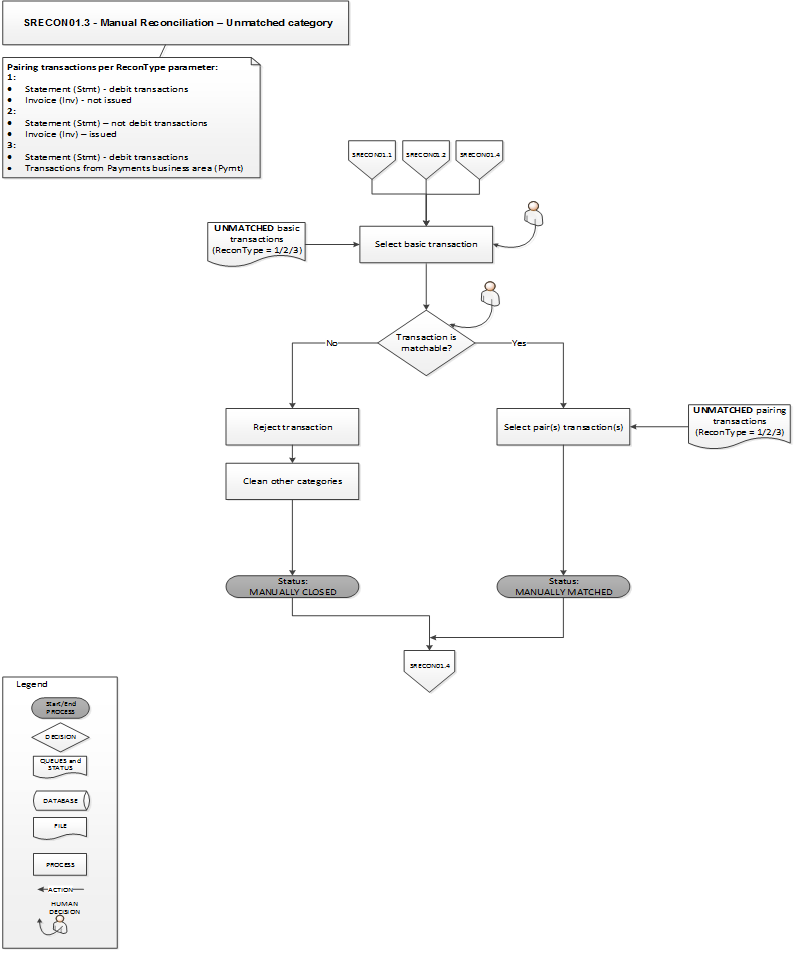

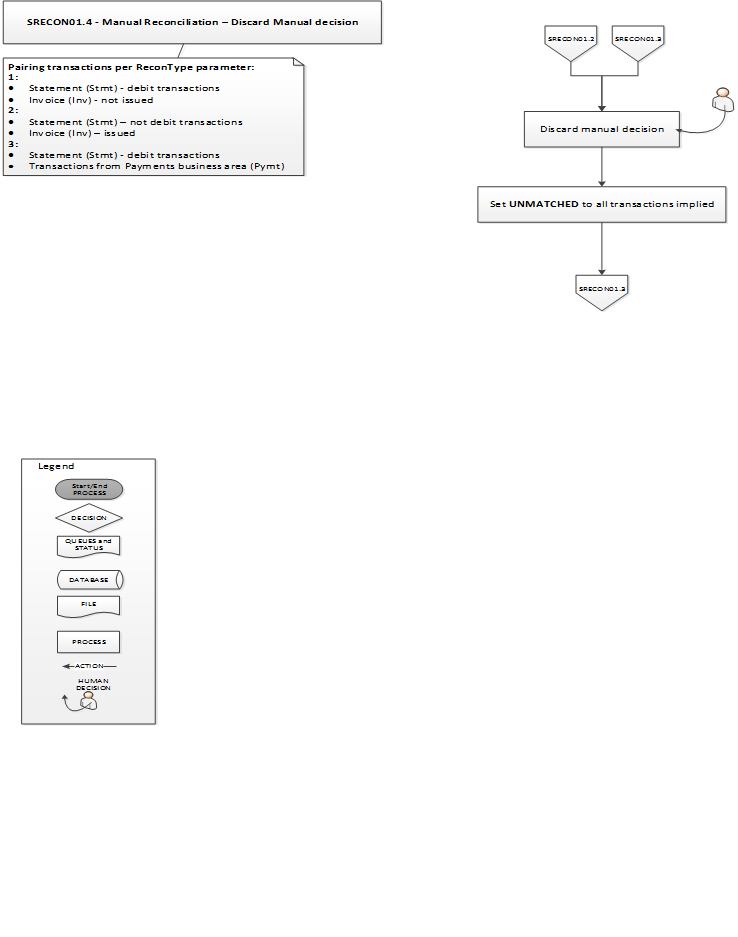

We here describe the reconciliation process:

The data analysis algorithm screens for relationships between processed transactions and creates pairs and possible pairs of transactions. A ranking system is implemented, that chooses those transactions that are the most probable pairs. Where automated relationships cannot be found, the user is shown possible pairs, available for manual matching.

There are two options for reconciliation: automated and manual. Transaction categories eligible to this algorithm are:

The criteria for creating pairs of transactions is a series of fields that are part of these categories, with an exact match. The algorithm learns while processing data and suggests pairs of transactions based on historic behavior.

In the analysis of data available for payments and invoices, a number of scenarios where matching could fail were identified:

Below are the processing flows, including states of transactions and statuses:

If you wish to collaborate with Allevo and Bakken & Bæck to test beta functionality, available in the near future, we are more than open to run some tests with some early adopter SME companies. You help us improve our solution and maybe you gain improvement of own financial processes.

What we bring is not a robotic type of automation, but an automation that improves the process and that makes it safer and more transparent.

Allevo participated at CFO Conference on March 4th 2021. The event gathers Chief Financial Officers, entrepreneurs, business owners, top managers, fiscal consultants and experts in finance from smaller and larger corporates active on the Romanian market. Our slot was included in a panel discussion, with 397 live participants. This was the perfect audience to introduce Allevo, the experience we have in banking and how we can help address some of the issues these companies face.

Although online, we were able to address some questions and learn from our future customers what they are missing in relationship with their partner banks. One CFO says their partner bank facilitated in 2020 the centralization of their business units and helped them automate some of their processes, solving the cashpooling issue they faced.

Another CFO said banks play a very important role in the business environment and need to fund operations of smaller companies, to keep a healthy and steady economy afloat.

The third CFO replied that the most important role a bank plays is not that of funding, but helping with cash management and incoming payments, and the automation of financial processes.

This was a very good confirmation that the problem we are solving by implementing the Whizzer project is still not addressed yet. Even larger corporates still run a lot of manual financial processes in their day to day activities. This was the perfect context to present some of the results of the Whizzer project: the service itself that allows a company to get bank statements from all its partner banks and run a reconciliation process between invoices issued to customers and incoming payments, and invoices received from suppliers and outgoing payments. This helps a business owner get a better understanding on the cash at hand, and allows them to manage their liquidity way before the balance sheet is delivered by the accountant.

Why is this needed? Because not all business owners afford to hire a stand-alone CFO and quite often this role is covered by the owner, who is also a sales person, and a CEO, and a support contact for customers, all at the same time. Financial decisions are critical and need to be based on acurate data. Whizzer comes to the rescue by providing an overview of the cashflow situation, what payments and invoices look like, a rough balance sheet based on information processed by the application and an accounts payable, accounts receivable department in its own right.

While implementing the application we learned the following:

The audience seemed enthused by the proposal, and we already received a request for proposal after the event.

The Whizzer project is implemented in Bucharest, has an end date of 30 November 2021 and a total value of EUR 738.375, out of which EUR 420.000 non-refundable grant. The Whizzer project is aimed to create an open source software solution that offers financial operations as a service to SMEs, to help them automate and centralize common financial flows, at a very low cost: balance sheet, salary payments, invoicing, money flow automation, accounts payable and receivable, cash reporting. Target group includes banks, financial service providers and SMEs across Europe, with focus on SMEs, in terms of technical harmonization and communication on top of a well-built open banking layer.