It’s that time of the year again when we wish everyone a Merry Christmas and a Happy New Year! Before taking time to relax and reflect on life, the universe and everything, we look at 2019’s achievements.

The board of Allevo is extremely proud to have accomplished so much in what feels like 3 years, not just 12 months. A warm thank you to all our customers, partners, supporters, suppliers, fans and last, but not least, colleagues, for helping us get this far!

Photo courtesy of InnovX

- Strategic partnership with DocProcess – Feb 2019 https://allevo.ro/wp-content/uploads/2019/02/EN-Allevo-and-DocProcess-A-Tech-Alliance-for-the-Future-of-Global-FinTech.pdf

- The partnership with SWIFT was extended, now covering both Romania and Moldova – Mar 2019

- Submitted a grant application to MCSI for a solution that helps SMEs achieve financial inclusion using the rails set by PSD2 and open banking – Apr 2019

- Fintech Finance interviews Allevo and Erste Bank to show innovation coming from Romania – Jun 2019 https://www.fintech.finance/01-news/fintech-finance-presents-the-regtech-show-2-01-open-banking-eastern-outflanking/

- The TOSS project has been extended with 6 months, adding API interfaces to the original architecture and design – Sep 2019. We also just went through an audit lead by the Ministry of European Funds, an opportunity to do a quick health check on the structure of financial information and deliverables. And with good feedback! https://allevo.ro/wp-content/uploads/2019/09/Comunicat-de-presa_Allevo-anunta-prelungirea-proiectului-TOSS.pdf

- Strategic partnership with WSO2 to deliver well designed open banking solutions – Sep 2019 https://allevo.ro/wp-content/uploads/2019/09/Allevo-and-WSO2-Partner-to-Provide-Open-Banking-Solutions-in-Romania.pdf

- We offered consultancy, test and validation services to banks, to audit their implementation of Open Banking solutions for PSD2 compliance – Sep 2019

- Allevo recognised as ‘National Winner’ for Innovation in the prestigious European Business Awards competition – Sept 2019 https://allevo.ro/wp-content/uploads/2019/09/Press-release_-Allevo-named-National-Winner-for-Innovation-at-EBA.pdf

- Allevo exhibited in the Discover zone at Sibos, the largest event to date, graciously organized by SWIFT in London ExCel. There’s an interview available with Fintech Finance (thank you Ali Paterson and Liz Lumley!) and a podcast with Brett King on the launch of Breaking Banks in Europe – Sept 2019 https://www.sibos.com/conference/exhibitors/allevo-37b

- CEC Bank is live on SWIFT GPI with the help of Allevo FinTP feature for GPI – 30 Sept 2019

- Allevo has been selected in BCR-InnovX accelerator program for Scale-ups and is on a back to school spree until Feb 2020 – Oct 2019 https://www.fintech.finance/01-news/allevo-selected-bcr-innovx-accelerator-program-for-scale-ups/

- In between events, we took the Allevo team on a casual teambuilding event at Conacul dintre vii and Budureasca wineyard (while it’s still legal) – 12 Oct 2019

- Ioana Guiman moderated the tech trends panel at the first “Annual Payments Forum” event organized by the National Bank of Romania, bringing banks, fintechs and the regulator under the same hood – 22 Oct 2019

- Ioana Guiman was part of the SWIFT #gpi panel, at the 10th edition of SWIFT Business Forum Romania, moderated by Marianna Janssen, alongside Deutsche Bank, Erste Bank, CEC Bank and Banca Transilvania – 24 Oct 2019

- We delivered FinTP-Instant to one of the top 5 banks in Romania, to help them use the Instant Payments service offered by TransFonD – Dec 2019

We are also extending our team with young and bright talent. If you dislike getting bored in a big corporate, if you like to know what you work for, if you want quick and honest feedback, then you’re right for the task.

Merry Christmas and a Happy New Year from all of us!

Note: The TOSS – Treasure Open Source Software project is co-financed by the European Regional Development Fund under the Competitiveness Operational Programme 2014-2020, Priority Axis 2 “Information and Communications Technology (ICT) for a competitive digital economy”.

Pentru informatii detaliate despre celelalte programe cofinantate de Uniunea Europeana, va invitam sa vizitati www.fonduri-ue.ro. Continutul acestui material nu reprezinta in mod obligatoriu pozitia oficiala a Uniunii Europene sau a Guvernului Romaniei. Proiect finantat in cadrul POC, Axa prioritara 2, Acțiunea 2.1, Prioritate de investitii 2b. Cod MySMIS: 115724, Nr. Contract Finantare: 101/16.08.2017.

Allevo team was very excited to celebrate 21 years on the market on November 21, 2019, with very distinguished guests: customers, partners, colleagues and supporters.

We also organized our 32nd edition of the User Group Meeting were we wanted to find out more about the issues that our clients and invitees are struggling right now, in the context of so many new regulations for the financial banking system. So we have created a debate about:

- SWIFT products and services, especially SWIFT gpi;

- Open banking and our partnership with WSO2;

- Instant payments and FinTP Instant Payment feature;

- qPayIntegrator migration to FinTP;

- the extension of the TOSS project -FinOpsSuite, our corporate treasury solution, part of the EU-co-funded project “Treasure on Open Source Software” -until March 2020. We also had a live demo session about the project;

- live demo about Allevo’s Money Liquidity module;

- TARGET2 –TARGET2Securities, cross-border payments and universal confirmations.

A sneak preview of the atmosphere can be found on our Facebook page (full photo gallery on Facebook).

Job Description

- Implementation projects for Allevo product portfolio

- Contributes to defining solution architectures and technical analysis

- Installs, configures and administers:

- Operating systems: IBM, AIX, Linux, Windows (including HA Clusters)

- Middleware: IBM WMQ, Apache MQ, Microsoft BizTalk, WSO2

- Database: Oracle, PostgreSQL, MSFT Sql Server

- Application Server: IBM WAS, Weblogic, JBOSS, Apache Tomcat

- Allevo open source products

- Customer support services for Allevo and third party products as agreed in the Software Support Services contracts (recurrent services, on-demand, version management and so on)

- Provides on-site and remote assistance using the Help Desk service

- Communicates and interacts with customers (technical, operations and business areas) and also with Allevo teams (development, test, business analysis, sales)

Job Requirements

- Bachelor’s degree in Computer Science or a closely related field

- Strong technical skills

- Experience as system administrator or database administrator

- Various OS administration skills (Windows, Unix/Linux, OS400)

- Experience with either of: database (Oracle, Postgres, others), middleware/messaging (IBM WebSphere MQ, ActiveMQ), application servers (IBM WebSphere Application Server, Weblogic, Jboss, Apache Tomcat), WSO2 API Manager

- Nice to have: understanding of financial message standards, financial market infrastructures, banking operations

- Likes to work as part of a team

- Languages: Romanian, English

- Will to learn

Job Benefits

- Competitive income package, including health insurance and food vouchers

- Professional training: courses, workshops, conferences, support for certifications (IBM, Oracle, Microsoft and others)

- Opportunity to learn from our team of experts

- Opportunity to acquire competences on SWIFT platforms and services (Allevo is one of the 8 SWIFT partners, having direct access to their test environment)

- Being part of financial and banking projects in Romania, as well as abroad

The payments ecosystem is rapidly transforming and new challenges are arising continuously. Allevo is directly involved in assisting financial institutions to successfully face these challenges. Through our software products and value added professional consultancy and support we are able to assist our clients on a step by step basis in any hot projects linked/relevant to the payments area.

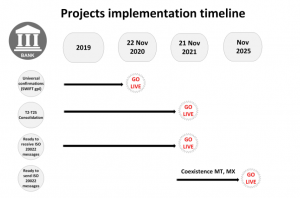

In the context of the T2-T2S consolidation, the migration of cross-border payments and cash management messages to ISO20022, banks are expected to send universal confirmations for the payment instructions they receive through SWIFT messages, Instant Payments, compliance with PSD2. For this puropose, banks are also required to adapt the internal applications for interfacing with SWIFT gpi or Open Banking. These are the projects that Allevo is and will continue to be directly involved in for the next years.

On our list, the most urgent projects that banks must start preparing for as we speak, in order to be ready on time, are:

- TARGET2-TARGET2Securities consolidation (migration of the financial messages from the MT format to ISO20022 – to be finalized in November 21, 2021, as per Eurosystem’s imposed deadline).

- The migration of cross-border payments from MT Category 1, 2, and 9 messages, to their ISO 20022 equivalents – deadline: November 2021 for receiving payments in ISO20022 format and November 2025 for both incoming and outgoing cross-border payment flows in ISO20022 format – deadlines set by SWIFT.

- SWIFT gpi – a service offered by SWIFT to monitort he progress of cross-border payment instructions throughout their entire payment channel, offering to the participating banks visibility, transparency and processing speed for the payments sent and received. Although joining SWIFT gpi service is optional, starting with November 22, 2020, all SWIFT members will be required to confirm in the gpi Tracker that the funds have been credited in the beneficiary’s account. This is a mandatory requirement for all incoming cross-border payments, in order to create visibility and traceability on the status of a payment. SWIFT gpi seems to become the new standard for cross-border payments on SWIFT network.

Allevo is here to offer banks the support needed to ensure compliance with all these projects, by constantly providing technical solutions along with its 20 years experience and know-how in processing financial transactions according to the financial industry standards.

Sorina Bera, CEO Allevo joined a panel at the Future&Security of Financial Services conference, organized by Oxygen Events. The event that was on October 31st brought together decision makers from banks and companies.

Our CEO, Sorina Bera, moderated the focus session: “Transforming the Payments Ecosystem”, in the first panel of the event, were she had as guests: Radu Zanfir, Head of SWIFT Department CEC Bank, Bogdan Liviu Barbu, Deputy Executive Director of Operations Division, BCR and Marius Caraiani, IT Director, Informatics Department, Smith&Smith Payment Institution.

Radu Zanfir, talked about the benefits that SWIFT gpi brings to banks and the improvements it has for the customer-bank experience. The service is operational at CEC Bank starting September 30, 2019 and the bank plans to extend it.

Another hot topic for the banks is instant payments, and Bogdan Liviu Barbu, from BCR explained that the bank he represents implements the system as we speak, while Marius Caraiani, from Smith&Smith Payment Institution continued speaking about an important project for his company and more for its clients: implementing a software solution for API exposure to third parties.

The first session was moderated by Rodica Tuchilă, Executive Director of the Romanian Banking Association (ARB) and the second one by Toma Cimpeanu, CEO ANSSI. The event was opened by Radu Gratian Ghetea, Honorary President of the Romanian Association of Banks.

Other subjects debated as part of the conference include: digital Romania, Payment Service Directive (PSD2), the potential of blockchain technology, information security management, competitive intelligence, cyber intelligence.

Ioana Guiman, Managing Partner Allevo participated at the 10th edition of SWIFT Business Forum Romania, held this year under the “Looking to the future of payments” umbrella. The event, a tradition for the local market, was organized on Bucharest on 24th of November by the Romanian Banking Association and SWIFT.

Ioana was invited to speak on the SWIFT gpi panel moderated by Marianna Janssen, SWIFT gpi expert EMEA, and shared the stage with Marc Recker from Deutsche Bank, Cristian Cengher from Erste Group Bank, Radu Zanfir from CEC Bank and Adrian Radu from Banca Transilvania.

More information about the event can be found on our blog.

The high-level theme of the event was “Looking to the future of payments”. A traditional event, at its 10th edition, SWIFT Business Forum Romania was held in Bucharest on 24th of November and organized by the Romanian Banking Association and SWIFT.

More than 100 representatives from financial institutions discussed about the challenges that impact the payments industry in the context of rapid transformation of the EU payments landscape. Changes in consumer behavior, faster and real-time payments, open banking models, new regulations, technology disruption, compliance pressure are among the challenges that affect and reshape the payments space.

In the opening plenary Dr. Radu Gratian Ghetea, President of Honour of the Romanian Banking Association, and SWIFT National Member Group Chairperson and Sergiu Oprescu, Chairman of the Board of the Romanian Banking Association made a radiography of the Romanian banking system, followed by Matthieu de Heering, Head of Central & Eastern Europe, SWIFT who presented the SWIFT 2020 Strategy update.

Other topics include:

- Tanja Van Sterthem, Financial Service Consultant, Standards Advisory Team, SWIFT presented details about the migration of cross-border payment traffic to ISO 20022 that start in November 2021;

- In the Evolution of the European Payments Landscape, Rodica Tuchila, SWIFT User Group Chairperson, Romania, moderated a panel of SWIFT experts and representatives of the National Bank of Romania and Banca Transilvania. They discussed the EU payments landscape and the impact on the Romanian market;

- As cyber-attacks become more frequent and sophisticated, Frank Versmessen (SWIFT) talked about securing the financial ecosystem, followed by Gizem Tansu (SWIFT) who presented the Financial Crime Compliance Portfolio of SWIFT.

Marianna Janssen SWIFT gpi expert EMEA, moderated a focus session on SWIFT gpi. Allevo was represented by Ioana Guiman, Managing Partner Allevo and shared the stage with Marc Recker from Deutsche Bank, Cristian Cengher from Erste Bank, Radu Zanfir from CEC Bank and Adrian Radu from Banca Transilvania.

The 10th edition of the SWIFT Business Forum Romania was instrumentally put together by the Romanian Banking Association. Special thanks to Rodica Tuchila, Executive Director at the Romanian Banking Association, and Judit Baracs, Country Manager Romania SWIFT, for the flawless organization.

Allevo was invited by the National Bank of Romania to moderate the “New technologies – trends, innovative tech solutions, new business models” panel, at the Annual Payments Forum.

The event marks an amazing step in the evolution of the financial services industry in Romania. The National Bank of Romania launched the Fintech Innovation Hub, a collaboration platform meant to bring together banks, fintechs and the regulator. This is a first on the local market and comes in to confirm that the fintech space in Romania is strong and growing and that beautiful things can happen when all players come together at the same table. And the fact that this initiative comes from the regulator is a truly wonderful thing that happened to this industry.

Video intro: https://lnkd.in/e3dA3N4

The panel was moderated by Ioana Guiman and on stage there were:

- Sorin Cheran, Artificial Intelligence Chief Technologist HPE

- Alberto Guidotti, Founder, Euronovate

- Tudor Cristea, Regional Sales Manager, Palo Alto Networks

- Cristian Pielescu, Founder, Convex Network

- Ștefan Ionescu, Managing Partner, Lew.ro

- Razvan Boldis, Founder & CEO, indexAR

At Sibos this year we announced:

- our selection in BCR-InnovX accelerator for scaleups

- the gpi feature of FinTP, already live with the first bank to onboard gpi in Romania

Sibos 2019: Ioana Guiman, Allevo from Advertainment Media on Vimeo.

Allevo, one of the very few remaining business partners of SWIFT, exhibited at Sibos in London ExCel in a different way. We had a booth in the Discover zone, right next to the impressive Innotribe stand.

We position ourselves as a startup with 20 years of experience in financial services.

We provide software solutions that help banks, companies, microfinance and public administration process financial transactions and achieve compliance.

We started out by creating software solutions that helped connect bank back-office systems to external market infrastructures. Our software automates payment flows and processes for banks and corporate treasuries, while providing compliance to standards and regulations.

We are proud to have 31 financial institutions from 4 countries as customers, serving 69% of the market share in Romania.

Products on Show

FinTP: back-office integration, financial process automation, reconciliation

FinTP-Connect: PSD2 compliance

FinTP-Aggregator: taking Open Banking to the next level

FinTPc: the TOSS project – an open source application that automates financial flows for companies and corporate treasuries, a project co-financed by local and European authorities

FinTP-Instant: an Instant Payments feature that helps banks and payments service providers achieve technical integration with Instant Payments Systems (either TIPS or local/regional)

PSD2 implementation test and validation services