Monthly Posts: October

Allevo to help Micro-Finance Institutions looking to improve their operations

We invited local financial non-banking institutions to show how our solution desgined specifically for them can improve their operations. All this in a dedicated workshop and on October 28.

It was also a get-to-know-each-other event, with us looking to understand what MFIs in Romania are looking for from a solution provider and MFIs interested to find out how Allevo can help. Participants said MFIs are looking for something new to be implemented on the Romanian market, something that can be truly useful for both the institutions and their customers. And we were happy to hear they believe Allevo can help them be more creative and even surprise their customers with new services.

The workshop also enjoyed the presence of Dutch consultant Ruud van der Hoorst, whose presentation took a closer look at microfinance from different perspectives: credits, deposits, money transfers and insurance, also showing them by comparison between MFI and normal. He then presented the Musoni case study, a Dutch microfinancing institution which gives loans using the MPESA service of Safaricom in Kenya. Musoni has built a “battle tested” system with Allevo’s solution in the middle as traffic agent and law enforcer, which facilitates very controlled straight through processing.

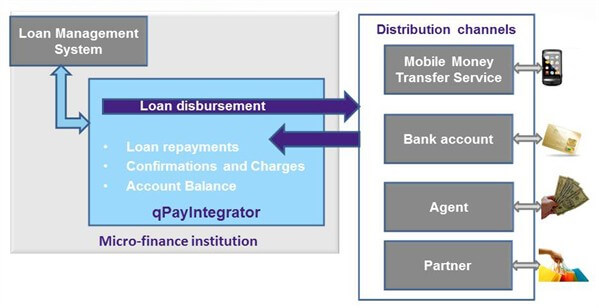

Like shown in the picture below, Allevo’s solution for MFIs enables integration; flow automation; disbursement management; processing and reconciliation for disbursements and loan repayments, system confirmations, system charges and account balance; monitoring, investigation and alerts; advanced reports.

And here’s a short movie that can help you better understand how it works.

Don’t forget, if you are a Micro-Finance Institution in search for a solution to optimize your operations and you missed our workshop this week, just contact us.

BOOSTing (Banking On Open Source Technologies) the public sector’s payment services

Allevo, Sibos exhibitor for the last 7 years, hosted the debate “Financial Infrastructures for Public Administrations” in the Open Theater space. The session focused on rationalizing the state’s payments service. Alina Enache, Allevo Sales Manager and Mihai Guiman, Vice-president FINkers United, jointly presented how using specialized open source software applications leads to streamlining the operations of public institutions, to mitigate their operational risk and to offer a platform to scale-up delivered services. More precisely, they talked about an open source solution (FinTP) for managing public payments, architected as a service and hosted by a governmental private cloud.

A couple of years ago, Allevo embraced a major cultural change by deciding to depart from the controlled distribution of the company’ software applications, and choosing instead to freely share them. Allevo believes that this business model shift will alleviate the partnership in complementarity, will create a shared innovation platform for processing financial transactions along the entire supply chain, and, not least important, will potentiate the fundamental value of business ethics in intellectual property (IP) related trades.

There is a smaller adoption rate of open source software at the application level in the financial industry compared to other critical industries such as health care, education, automotive or utilities. Still, Allevo banks on the chance that market players (both solution providers and beneficiaries) will evaluate how they can architect their operations based on the freely available FinTP, the financial transactions processing application published into open source. Another important driver relates to financial institutions’ (FIs) business model. If, for instance, financial inclusion is their core business, than commodity solutions become instrumental in achieving the right level of accessibility.

Countries with a poorer level of banking services or with a less mature banking system can be subject to governmental policies or investment to enlarge financial inclusion. Furthermore, governments – which are generally speaking the largest corporation in a country – ‘employ’ (directly or indirectly, the latter including retired persons, beneficiaries of subsidies or social assistance, etc.) massively: in some cases up to 30% of the population is on their payroll; this in itself represents a powerful enough reason to look for better efficiency of their own operations.

Based on a fruitful partnership of over 10 years between Allevo and the Romanian State Treasury, during which we handled their most important financial operations, led us to conceptually develop this into a full-fledged solution. This Open Theater session at Sibos addressed a proposed solution that centrally manages all public administration payments – which can be extended to tax collection, public debt or public funds management.

Unlike corporate or banks’ treasuries, the State Treasury is a zero risk operation, where any solution should ensure human error containment. Furthermore, functional, technological and highly scaling (according to the evolving needs) data repositories should be warranted, while transparently interoperating with the business community’s members (i.e. with FIs).

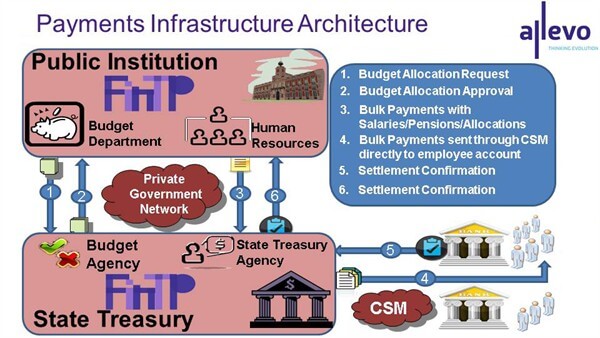

Our solution is built around FinTP, architected as a service hosted by a Governmental Private Cloud, as depicted in the picture.

FinTP is configured to fulfill the budget allocation, bulk or urgent payments issuing, and end-to-end tracking and reconciling mechanism – as shown by the numbered arrows suggesting the operational flows. FinTP also helps generate beneficiary public institutions’ reports based on the settled payments, including liquidity reports and forecasts based on accounts balance.

In the particular case of Romania, the State Treasury acts as a direct participant to the electronic payment system in order to communicate with commercial banks, and directly connects to the RTGS and ACH systems, either through the SWIFT Network or a dedicated Proprietary Network.

The main advantages of this architecture implementation are:

- Achieving end-to-end automation – Straight-Through Processing (STP)

- Operational risk containment

- Reduced settlement time

- Reduced operational cost (cash is expensive)

- Automatic accounting reconciliation

- Cash flow forecast

- Improved user experience

- Security and confidentiality of information (by safely exchanging sensitive information over private secured networks, instead of moving paper or exchanging emails)

- Eliminating delays in paying salaries, when public institution accounts at commercial banks are subject to seizure due to possible legal disputes

- The solution can be extended in the future to offer a wider range of functionalities (e.g. extension for distribution/collection channels on electronic channels like M-PESA, mobile wallets, Apple Pay etc.), with a direct result of increased tax collection and offering a more consistent service for the citizens both as beneficiary and as payer.

This article is an open invitation to BOOSTing together any particular element of the financial services supply chain, and a call to join our FINkers United community.