Using Allevo transactions filtering solution, Raiffeisen Bank Romania reduces exposure to terrorism financing activities for domestic payments

Allevo and Raiffeisen Bank Romania have successfully developed and implemented the first Romanian software solution for real-time, online transactions filtering on the local market dedicated to banks with large transaction volumes.

The solution screens the local payments instruments that present a certain degree of risk, offering the possibility to analyze them and to take the required decision of authorizing or rejecting the payment before the actual funds’ transfer.

Allevo solution helps Raiffeisen Bank Romania eliminate the risk of financing terrorist activities and, at the same time, meet the regulatory requirements of both local and international legislation related to this sensitive compliance aspect.

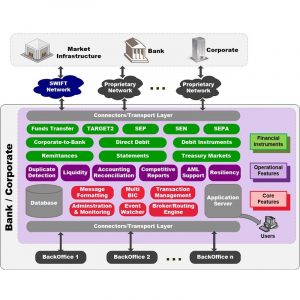

The solution ensures transactions filtering for low value domestic transactions on qPayIntegrator, using various lists (official sanctions lists and bank’s internal lists) that can be easily customized and managed by the bank and provides the compliance teams with an efficient way to analyze suspicious messages and take faster decisions. The screening feature is fully integrated in the payments’ business flows, providing a rich set of specific statistics and reports.

“Using the transaction filtering extension of qPayIntegrator and teaming with Allevo professionals enabled us to ensure an efficient filtering technology to eliminate the risk of terrorism financing for domestic low value payments, and consequently to provide increased protection of the funds transfer” states Mr. Ionel Fierascu, Compliance Director in Raiffeisen Bank Romania.

“The powerful anti-terrorism financing features have facilitated the timely alignment of the bank’s operations to the market regulations and fulfilled the bank’s business needs, leading further on to its clients’ business protection” says Sorin Guiman, CEO Allevo.