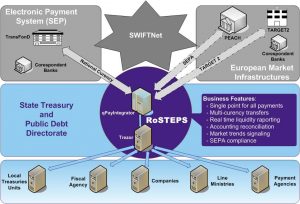

Using qPayIntegrator, the Romanian State Treasury significantly improves the financial management of public funds providing tight alignment with banking industry regulations

The delivered solution addresses the management of the Structural Funds by creating a beneficiaries’ closed user group. This group’s financial business is administrated by the State Treasury within MoPF according international banking business standards and practice, taking advantage of its SWIFT full membership status.

The foundation of the approach is that the State Treasury is best placed to harmonize, in the initial stage, the financial execution of the projects, providing all actors an enriched and cost-effective portfolio of products and services. Additionally, it capitalizes on its current investment and takes advantage of the built-in business scalability features.

The delivered solution conveys significant advantages:

- controlled financial execution, taking advantage of the most secure funds conveying channel

- transparency and auditing features necessary in the financial management of the public funds

- operational risk containment

- advanced liquidity reporting and forecasting features

- business alignment to EU financial regulations: qPayIntegrator, Allevo’s centralized payment hub, has been recertified SWIFTReady SEPA 2009, and, on top of it, is running on Microsoft BizTalk Server platform – also a SWIFTReady EAI certified solution

- technological alignment with state of the art products and tools provided by Microsoft.

“Deploying the pilot went smoothly because it took advantage of the practice proven processes, the already acquired organization culture and skilled execution team running the present payment system – also delivered by Allevo – within the State Treasury” declared Laurentiu Andrei, General Manager of the State Treasury and Public Debt Division.

“We believe this will become a reference model for other EU State Treasuries, after successfully exploiting the interoperability of a governmental body and the business community”, says Sorin Guiman, CEO Allevo. “Early compliance with new standards of the Public Administration will also give financial institutions and corporations a jump-start to SEPA compliance.”

The announcement again demonstrates the commitment BIS has to providing solutions most closely aligned to market regulations, standards, and infrastructures for its customers.

“For many banks and corporations across Europe, the implementation of the Payments Services Directive (PSD) and Single Euro Payments Area (SEPA) requirements is a major challenge,”says Susan Hauser, vice president, Worldwide Financial Services, Microsoft. “Banks are focused on achieving greater interoperability and higher quality distribution channels that provide enhanced treasury services to customers in order to help them realize the economic benefits of SEPA. We are pleased to be working with leading financial services partners such as Allevo to help our customers achieve these goals.”