FinTP-Instant is a new functionality of FinTP which connects back-office applications of a bank to an Instant Payments service offered by a third party, such as the Romanian ACH, TransFonD.

FinTP-Instant is a new functionality of FinTP which connects back-office applications of a bank to an Instant Payments service offered by a third party, such as the Romanian ACH, TransFonD.

Extensive documentation and testimonials aside, we captured for you the true essence of the KYC compliance utility of choice for the global banking community, none other than SWIFT’s Know Your Correspondent Registry, appropriate for Banks correspondent relationships.

Also, please know that the KYC Registry holds information about institutions, not about individuals or private customers, and the data relevant to Customer Due Diligence requirements includes among others, the following:

These being said, we kindly invite you to join the nearly 5,000 banks already in the KYC Registry. Please know that we are here to promptly offer you our assistance in this process.

*Allevo is SWIFT Business Partner and Registered Vendor. As part of this partnership Allevo promotes SWIFT product and service portfolio in Romania.

**The content of this blog post belongs to its author and does not reflect the official position of SWIFT.

***Should you wish to contact us, you may do so via e-mail / website form.

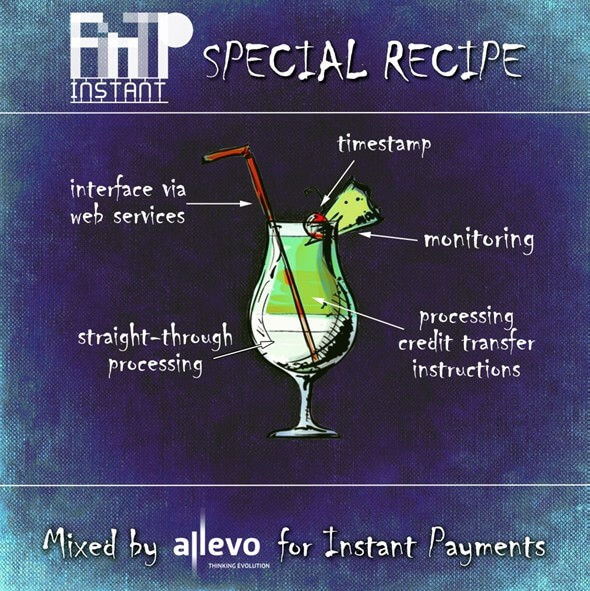

FinTP-Instant is a new functionality of FinTP which connects back-office applications of a bank to an Instant Payments service offered by a third party, such as the Romanian ACH, TransFonD. This functionality retrieves payment messages in the format provided by these applications (database tables, message queues etc), converts them to the ISO 20022 standard and routes them to the Instant Payments System (IPS).

One of the requirements of the IPS is for the bank application to have STP capabilities (straight through processing). FinTP successfully meets this requirement, interfacing with the ACH through web services.

In order to fall within the appropriate processing timeframe defined for the instant payments service, the timestamp is created by FinTP.