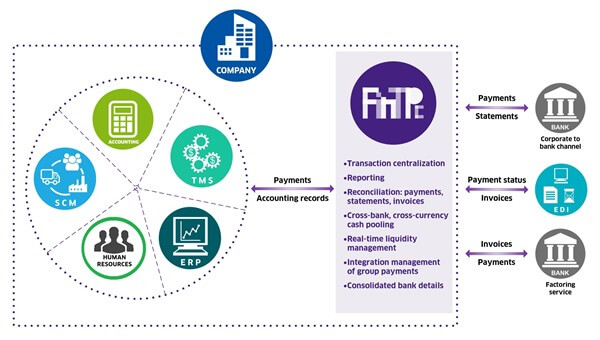

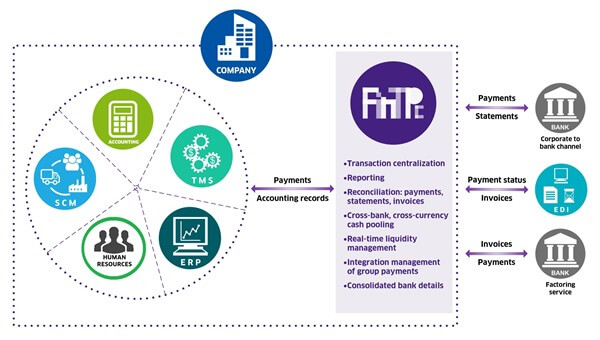

Having FinTP as a starting point, FinOps Suite (our SMEs & corporate treasury open-source software solution) follows the same high-level architecture, but features a new user interface and reworked functionalities and workflows.

As its tagline suggests (Making financial operations easy), FinOps Suite is aimed to automate a company’s processes and flows in treasury departments.

It is positioned in the center of financial flows within a company, integrating core systems that process financial transactions (Human Resources Application, ERP, EDI, Accounting) and applications connecting to banks, either directly (Internet Banking / Cash Management application) or via market infrastructures such as SWIFT or local CSMs.

FinOps Suite Key Benefits

- Consolidation of all corporation/group financial transactions

- Streamlining operations by:

- integrating payments from other applications

- flow automation

- automatic generation of consolidated reports

- risk containment of duplicate or invalid payments

- Reducing fraud-related risks in connection with bank interface access

- Generating reports and company relevant statistics

- Reconciliation between payments and bank statements and/or invoices

Product Features

All custom FinOps Suite configurations / deployments are made up of the following mandatory features:

- Administration

- Users and Rights

- Application Management and configuration (including routing logic, parameters, alerts, validations)

- Business Management configuration of various lists (partner banks, entities and accounts, partners and accounts, black lists and so on)

- Application Interfaces – external interfaces to other applications, for importing / sending financial transactions in various structured formats

- Payments from Back-Office

- Bank Statements

- Invoices from Back-Office

- Transactions Processing

- Create/Edit Transactions (including enriching them based on the lists defined in FinOps Suite)

- Transaction Templates

- Reporting – predefined or customized reports based on persistent data stored in FinOps Suite

- Audit Trails – ensure the basis for tracking workflows and exceptions or recording user actions within the application, necessary for performing investigations for exceptions or consistency checks

- Archiving – automates the export of processed data from FinOps Suite into backups (external files), based on criteria specific for each workflow

While optional, Reconciliation is a highly sought feature, providing support for automatic or manual matching between two sources of data.

*FinOps Suite is the business name of the software solution being developed within our Treasure Open Source Software (TOSS) project. This project is co-financed by the European Regional Development Fund under the Competitiveness Operational Programme 2014-2020, Priority Axis 2 “Information and Communications Technology (ICT) for a competitive digital economy”.

In Romanian:

Pentru informatii detaliate despre celelalte programe cofinantate de Uniunea Europeana, va invitam sa vizitati www.fonduri-ue.ro. Continutul acestui material nu reprezinta in mod obligatoriu pozitia oficiala a Uniunii Europene sau a Guvernului Romaniei. Proiect finantat in cadrul POC, Axa prioritara 2, Acțiunea 2.1, Prioritate de investitii 2b. Cod MySMIS: 115724, Nr. Contract Finantare: 101/16.08.2017.

Interview with Allevo: Aligning Instant Payments and PSD2 with banking customers’ needs

Sorina Bera, CEO at Allevo says that banks are clearly moving towards best serving their customers in order to keep them.

The trend is for regulation to come to the aid of people.

—

What are your main areas of focus in 2018 and what are your hot projects?

We started 2018 by focusing on projects relevant to the banking industry, which were added to the project pipeline by our customers.

As a result, we are implementing the Instant Payments flow via the FinTP-Instant feature. We are also busy validating our PSD2 compliance solution for banks (FinTP-Connect), and we are already involved in a proof of concept lead by one bank. Another point of interest is obviously making significant progress with our EU-funded project dedicated to SMEs and corporate treasuries: FinOps Suite (TOSS – Treasure Open Source Software).

As far as Instant Payments and PSD2 are concerned, we are already working closely with our banking customers to finalize the concept and business details over the coming months, whereas for FinOps Suite (to be completed mid-2019) this year is mostly dedicated to software development, website redesign, and of course, making the project known everywhere we see it fit. And hopefully a few extra surprises.

Besides processing financial transactions in FinOps Suite, our TOSS project also involves developing an automated testing tool and a benchmarking tool, both extremely useful for all the technical teams involved, as well as further extending our FINkers United community worldwide and promoting collaboration in the open source area. The good news is that these two latter tools are not only useful to corporate users of FinOps Suite, but also to banks and users of FinTP.

How are you helping banks serve their customers with a nearly instant payments service?

Banks are clearly moving towards best serving their customers in order to keep them. The trend is for regulation to come to the aid of people, allowing them to move freely between financial institutions, giving them the best and most cost-efficient service on the market. The challenge is keeping them interested by creating cool new products. This type of thinking, aligned with the need for speeding up the processes and for things to happen in real-time, with less to no lag, leads to services like instant payments to emerge.

The local Romanian CSM, TransFonD, announced in early 2018 the launch of the instant payments service for local banks on the market. In this context, we have extended FinTP with a feature to enable banks to use this service – FinTP-Instant.

FinTP-Instant is a FinTP functionality that connects back-office applications of a bank to the instant payments service offered by TransFonD, retrieving payment messages in any format provided by these applications (tables, queues, etc.), ensuring their conversion to the ISO 20022 standard and routing them to the Instant Payments System (IPS).

Besides the instant payment initiation, confirmation, reject messages, as well as recall and negative/positive answer to recall, this functionality also processes new messages pertaining to this scheme:

- SCT Inst transaction status investigation;

- Overdraft message for configuring the guarantee ceiling;

- Reconciliation messages, automatically sent by IPS after completing each settlement process.

In order to fall within the appropriate processing time for instant payments, the timestamp can be applied in FinTP-Instant and since this is a functionality of the FinTP engine, it can also benefit from transaction filtering.

What can you share of your experience in implementing your PSD2 solution with your banking customers?

We started the design of the PSD2 compliance solution in early 2017 and since then we have validated several layers of our product – architecture, communication, security, user stories and so on. We did this by working closely with our customers, as per our company strategy, collecting their feedback and specific requirements.

For confidentiality reasons, we cannot provide a list of on-going implementations and their progress, but what I can say for sure is that FinTP-Connect raised quite a lot of interest among banks. We will issue a press release as soon as our first customer goes live with this solution.

For now, we are happy that our PSD2 proof of concept benefited from the useful input of one of the major banks in Romania and once light started to be shed on needed functionalities, both teams joined efforts to implement this solution in a record amount of time. This is a defining trait for us at Allevo, as we have a customer centric approach, frequently collecting feedback from customers and designing solutions that solve their specific problems.

To be less mysterious though, we can disclose a couple of components featured in the architecture of FinTP-Connect:

- Centralized management of requests;

- Back-office integration;

- TPP identification & validation;

- API management integration;

- Data analytics;

- Access for PISP & AISP;

- Fraud risk management.

Other perks that come to the benefit of both banks and their business clients are: analytics instruments, cash flow management through predictive analysis and automated cash management.

Last, but not least, we are bragging with the way we position the FinTP-Connect solution, and that is not only as a PSD2 compliance solution for banks, but also as an opportunity for banks to offer far more interesting and attractive services to their customers. This, in our opinion, is the way to think things further and develop meaningful tech, to enable services that people actually need.

FinOps Suite is a project that runs until mid-2019. However, you are already in the search for early adopters – how is the search coming along?

Allevo plans to organize two workshops this year aimed at small and medium businesses: one just before the summer holiday, in a partnership we are looking forward to announcing, and another one early autumn. What we are trying to do is get the word out there, make the project known and, of course, collect direct feedback.

In addition to these workshops, we will also hold our annual User Group meeting probably at the end of 2018, which is another excellent opportunity to receive input from our current partners and customers. Besides spreading the news on our new company-oriented solution, we’re also bringing together all players involved in the corporate-to-bank financial flows, have them brainstorming ideas to improve these flows.

Another thing we did in this matter is that we applied with the FinOps Suite (TOSS) project in the European Business Awards sponsored by RSM and we are proud to announce that we have been named National Winner for Digital Technology. Thus, we will represent Romania at the European Business Awards Summit and Gala 2018 to be held in Warsaw this May – while still competing for both the European stage of this award, as well as for the European Public Winner position – based on the votes we receive for our company presentation video. If you like us, please vote by May 4th.

Source: www.thepaypers.com

The revised BIC standard (ISO 9362) approved in January 2014 is due for implementation by November this year and the changes it brings revolve around dropping info on connectivity and time zone.

This revision took into account market evolution, ensuring the standard is neutral and agnostic from any network, while also making the BIC more resilient going forward. This means that, except for the country code, the characters in a new BIC will have no meaning, while the specificities of the organization will be included in accompanying data attributes instead of being embedded in the BIC.

BIC Standard Changes

Elements within the code are redefined, references to the SWIFT network are removed (BICs will no longer be issued with “1” in position 8) and a new identification concept is introduced, namely Business Party (branch identifier, suffix, country code and prefix).

The most significant change is that the connection or disconnection of an organization to a SWIFT network service will no longer require the change of its BIC. The only exception: an organization with an existing non-connected BIC1 created before Nov 2018 that needs to be connected to SWIFT.

Also, please keep in mind that BIC owners will be responsible for the maintenance of the data related to their BICs and must keep it up-to-date and confirm the accuracy at least once a year.

Related SWIFT Services

With respect to ISO 9362, SWIFT has two roles: network provider (using BICs in the SWIFTNet and SWIFTNet FIN services) and ISO Registration Authority (responsible for the implementation of this standard). All the more reasons for SWIFT to introduce enhanced directory services in order to help the community support and adopt the revised standard: BIC Plus and BIC directory 2018.

BIC Plus (SWIFTRef’s new offering) is an event-based directory, with a completely different structure and several new attributes, such as: legal name and address, BIC publication, last update and expiration date, a BIC’s reachability over FIN, FileAct and InterAct, SWIFTNet connectivity status of a BIC, etc. Given the fact that the directory is commonly used in relation with internal applications to ensure a completely automated and accurate payments flow, we strongly recommend users to analyze the impact of the BIC Plus new structure at all levels of interaction with such applications that consume data from BIC Plus.

To ensure a smooth transition to the new structure of the directory, SWIFT supports the user community by providing a temporary solution – BIC Directory 2018, which ensures the same layout as the legacy one (to be fully decommissioned by November 2018), with the addition of basic connectivity and location code information. BIC Directory 2018 involves a minimal migration effort and it is available only for customers who have a BIC directory or BIC Plus subscription.

In order to benefit from the enriched data available in BIC Plus, we strongly encourage you to take all the necessary actions in your internal systems to accommodate the new structure and available file formats!

*Allevo is SWIFT Business Partner and Registered Vendor. As part of this partnership Allevo promotes SWIFT product and service portfolio in Romania.

**The content of this blog post belongs to its author and does not reflect the official position of SWIFT.

***Should you wish to contact us, you may do so via e-mail / website form.