Allevo covers hot topics in the financial industry in a series of articles published in Piata Financiara throughout 2017.

Brief history:

And here is the article collection for 2017:

Article Piata Financiara November 2017

Article Piata Financiara September 2017

Article Piata Financiara May 2017

Article Piata Financiara March 2017

The Paypers, IBS Intelligence and Bobsguide.com cover the following Allevo story:

With the revised Payments Services Directive (PSD2) coming into effect in January 2018, and based on the valuable input from its banking clients, Allevo developed FinTP-Connect, a software application for the centralized management of requests from TPPs (PISP/AISP) on behalf of the final customer.

This directive aims to increase competition, innovation and transparency in the financial market, as well as the security level for online payments and for accessing accounts and information. These goals are backed up by regulating new forms of payment institutions and introducing new interaction types, while opening bank APIs to third parties: Payment Initiation Service Providers (PISPs) and Account Information Service Providers (AISPs).

According to PSD2, PISPs will be able to initiate payments to an online merchant directly from the payer’s account, while AISPs will be able to retrieve information on the customers’ accounts, including the balance and transaction history. This leads to new potential payment solutions for the merchants, as well as new services based on the retrieved data, services offered by banks, FinTech companies and non-traditional financial services providers.

Taking all these into account, Allevo designed a solution which receives and processes requests coming from TPPs , sends them to the core banking systems and returns the requested answers to the TPPs. Specifically, FinTP-Connect ensures the reception of requests from PISPs and AISPs in JSON/XML – ISO20022 format and their transmission to the core banking systems in an accepted format, as well as the retrieval of answers in the core banking format and their transmission to the PISP/AISP as XML/JSON – ISO20022 elements.

FinTP-Connect features the following functionalities: API management, TPP identification and validation for access to services, rules management for applying Strong Customer Authentication (SCA), user activity tracking (TPP management and fraud risk management), log of services run by users, as well as native format configuration (in terms of requests from TPPs and responses from core banking systems).

The opportunities created by PSD2 address not only the newly introduced TPPs, but also banks and their customers. For example, by becoming an AISP itself, the bank benefits from the increased interaction with the client and an enhanced banking offer, but also has the possibility to monetize additional services like the integration with accounting, ERP or HRM systems, and cash flow management through predictive analytics.

Moreover, banks can also partner with IT service providers in order to put together accounting and management packages for SMEs, fully integrated with online banking, or services like DD mandate management, electronic invoicing and payroll file generation. As far as the banks’ corporate customers are concerned, they can benefit from analytics tools that would help them predict future trends in cash flow, which the bank could then use as a basis for offering an automated cash management service or even short-term financing.

Back to the application for PSD2 compliance, FinTP-Connect, Allevo shows its openness to run demos for financial institutions. The design of the application is flexible enough to accommodate any adjustments or new functionalities requested by each individual customer.

Sources:

Interview with Allevo CEO: Does PSD2 change everything for banks? It might, but all is not lost

Banks face a new compliance burden in January 2018, with the coming into effect of the PSD2 Directive. Allevo has set its course to help banks face this challenge and revolutionize the open banking sector as we know it.

—

What are some of Allevo’s most important projects and success stories to date?

Given the traditional, heavily regulated environment that Allevo addresses through its products, one of our most challenging (and rewarding) projects so far was the transition to the open-source model, started back in 2011.

At first, customers did not really understand the benefits of deploying an open source environment. However, this type of mentality has changed and now banks are looking into open banking solutions, which means that embracing this innovation-driven approach was the best thing to do at that time.

When it comes to individual projects tailored to our customers` needs, it is difficult to pick favorites. This is the reason why we decided to put together a puzzle from the pieces of our most prized implementations. We deeply cherish our collaborations and we look forward to adding new layers to it as our business and software engineering expertise grows.

With the PSD2 coming into effect in January 2018, how is Allevo helping banks achieve compliance with the Directive? What are the greatest specific challenges banks are facing?

PSD2 paves the way for significant changes across the banking industry. Of these changes, competition and the integration with TPPs, which banks will have to open their interfaces to, will have the biggest impact.

In the light of the upcoming enforcement of this directive, we decided to give banks a helping hand. For this specific reason, we started working on FinTP-Connect, an API-based application which enables banks to respond to information requests from TPPs, while also getting to know and serve their customers better.

This is basically an extension of our well-established core product, FinTP, which already provides technical integration between various business applications, while automating flows and enabling operational risk containment and compliance with regulatory and industry standards.

As recently announced, Allevo is developing its software solution, FinOps Suite. Can you elaborate a bit more on this project and its benefits for SMEs and corporate treasurers?

As Beneficiary of the Competitiveness Operational Programme 2014-2020, we have launched the TOSS (Treasure Open Source Software) project on August 16th, 2017. The software solution developed within this project – FinOps Suite – is focused on processing financial transactions for SMEs and corporate treasuries. The open source principle applied here is meant as an alternative to traditional software infrastructures these institutions are used to.

Marketed under the “Making financial operations easy” one-liner, the features of FinOps Suite include payment integration, validation, reporting and reconciliation, with the ability to accommodate further customer requirements. The target audience of this project consists mainly of SMEs, service providers, big manufacturers, financial transactions processors, and financial infrastructures.

Other potential extensions aim at the relationship between the corporation and its individual/institutional clients, as well as sharing certain information with them or even allowing some financial operations to accompany the exchange of goods or services.

What does Allevo bring different compared to other software vendors counterparts?

Our biggest plus is the open-source business model. Since we distribute our applications under the GPL v3 open source license, our technology drives cost reduction and conveys full control over the source code of the application, thus eliminating the common vendor lock-in dependence, while gaining access to both transparent product development process and product audit.

Furthermore, we have a customer intimate approach, with proven track record in designing and developing customized software tools, in order to serve clients of all sizes, in various industries.

As part of our strategy, we want to expand the customer base and sustain new product development. We are looking into new customer segments to diversify our solution portfolio, slowly moving to a flat organizational structure, comprised only of delivery, sales and support.

This strategy, correlated with the open source business model make Allevo stand out in the pool of software vendors out there.

What are the projects that you are most looking forward to in 2018 and beyond?

2018 is set to be a game-changing year for the financial industry. PSD2 already acts as a massive disruptor to budgets, resources, and processes. We aim to make all transitions as smooth as possible and ease the customer`s project implementation journey.

Besides the aforementioned FinTP-Connect (dedicated to PSD2) and FinOps Suite (for SMEs and corporate treasuries), we are also developing a feature dedicated to Instant Payments: FinTP-Instant.

This will connect bank back-office systems to services offered by CSMs like TransFonD, retrieving payment instructions (in any format provided by these applications), converting them to the ISO 20022 standard and routing them as dictated by the scheme. We will start this implementation by accommodating the service offered by TransFonD on the local market, for RON payments.

Source: www.thepaypers.com

On November 16, we organized the 30th edition of Allevo’s User Group Meeting.

Since this year is coming to an end, with 2018 already knocking on all our doors, the User Group presentation started with a focus on Allevo’s projects – past and future, our partnership with SWIFT, as well as the solutions we provide for the newly-regulated financial environment (PSD2, Instant Payments, GDPR).

In short, we talked about:

– SWIFT’s Customer Security Programme and the mandatory upgrade of SWIFT 7.2

– the opportunities of the Instant Payments project and our future launch of FinTP Instant

– our EU-funded treasury project for SMEs and corporates: TOSS project => FinOps Suite

– GDPR compliance

– our PSD2 approach with FinTP Connect

– the banking conference we held in Chisinau this October.

Our greatest achievement of the year was the EU-funded TOSS project, started on August 16th, with an implementation period of 2 years. Besides developing an open-source application suite dedicated to SMEs and corporate treasuries (FinOps Suite by its business name), Allevo will also redesign its 2 portals as part of this project, and will develop an automated testing tool, as well as a benchmarking tool.

All in all, 2017 was a busy year for us, with a lot of new projects on our plate (including upgrades and renewed certifications), but what’s to come is even bigger and of interest to all.

Here is a sneak preview of the atmosphere (full photo gallery on Facebook):

Discover our most recent project for SMEs and Corporate Treasuries /

Allevo Conference in Chisinau /

We attended Sibos 2017 in Toronto

The 8th edition of SWIFT Business Forum Romania was held by the Romanian Association of Banks on the 8th of November in Bucharest, with the kind support of Allevo.

Gathering around 100 representatives from financial institutions, the conference was focused on celebrating 25 years of SWIFT in Romania, along with debating challenges and opportunities for the financial banking industry, compliance issues and the inevitable digital transformation (a round table we were proudly a part of).

The opening plenary consisted of a SWIFT 2020 Strategy update, a SWIFT RTP update and what the strategy means for RO banks, as well as a presentation of the Romanian banking system 2020 vision.

The next topics of discussion were packaged in a 2-hour panel in which:

- Marianna Janssens (SWIFT) presented the Global Payments Innovation (GPI) initiative;

- Ruxandra Avram (National Bank of Romania) talked about PSD2 reshaping the payments business, as well as information security;

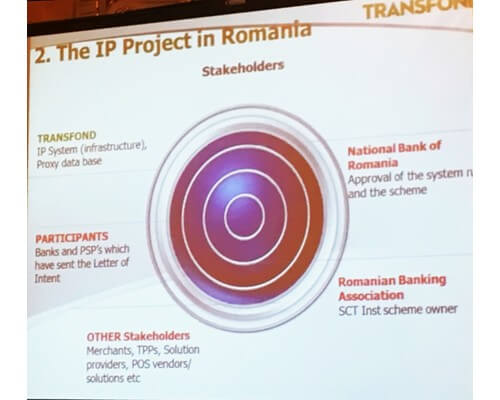

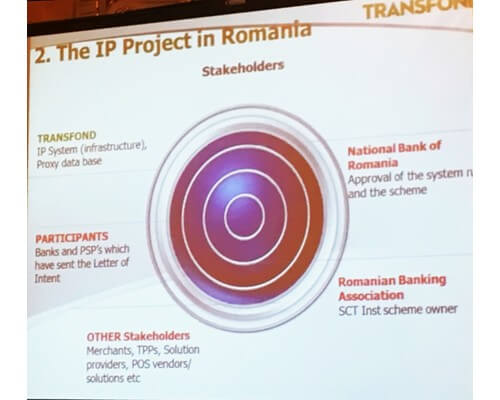

- Ionel Dumitru (TransFonD) showed the audience how the future of RON payments is “Instant”;

- Mihaida Meila (Central Depository) presented the securities market developments and announced the 10-year anniversary of her institution;

- Michael Formann (SWIFT) talked about reinforcing the security of the global banking system – CSP.

Panel highlights:

The No.1 counterparty for payments with Romania as the sender is none other than the US (over 20% of our international payments).

According to Capgemini’s report “The Currency of Trust: Why Banks and Insurers Must Make Consumer Data Safer and More Secure”:

- Either the information security management or the security policy are inadequate for 50% of banks.

- 79% of the financial institutions taking part in the survey are not confident about their ability to detect breaches.

Gizem Tansu (SWIFT) then held a focus session on financial crime compliance and the KYC Registry, stressing the importance of this secure shared platform for all banks and the fact that the documentation upload to the Registry is completely free.

Name Screening Service is another solution proposed by SWIFT, part of its support to the community in fighting financial crime, offering real-time online screening of single names and supporting effective sanctions compliance by enabling customers to efficiently screen single names of their own customers, suppliers and employees against sanctions, PEP and other lists.

Round table: The digital transformation – between opportunity and regulation

Allevo was represented at the round table by Sorina Bera (CEO), who talked about our current and future projects, including FinTP Connect (our PSD2 solution), FinOps Suite (part of the Treasure Open Source Software co-funded from the ERDF through the Competitiveness Operational Programme 2014-2020), as well as our Instant Payments approach.

Due to the rapidly-changing landscape of technology and regulatory compliance alike, software solutions providers must be one step ahead of all other players (be they banks, service providers or consultants), since their compliance to new regulations is based upon the formers’ ability to offer compliant solutions.

In fact, software solutions providers have to take the first step in terms of analyzing new regulations, in order to anticipate market needs and requirements, and in this endeavor we constantly consult with final beneficiaries, as a team, to come up with the best solution possible, one that really makes a difference.

Since we are all on the same side and have a common goal (compliance), team work is essential. Even though the regulator (in our case, the National Bank of Romania) was not part of this round table debate, they are in the same boat with the rest of us, considering that the ultimate goal of all regulations is to benefit the consumer most of all.

In terms of innovation, we strongly believe that its key purpose is to keep the customer satisfaction at the highest level possible and we keep that in mind when we develop all our products.

In the end, here are a few results of a Roland-Berger pan-EU study, who challenged 5 beliefs on digitalization:

- Customers request a digital banking experience – TRUE, and this is valid for all age groups, not only younger generations; it depends mostly on the levels of education and income. What banks can do is define relevant customer groups, compile digital offerings tailored to specific target groups and clearly communicate them.

- The higher the number of digital channels, the better – FALSE. The point is to develop end-to-end digital solutions to be able to address customers through the right channel, with a personalized offering.

- Online is revolutionizing banking – TRUE, but the possibilities are even greater, by offering additional value.

- The branch is dead – FALSE, but it needs to become more innovative! Banks should adapt the branch offering/service model and make it more attractive by adopting the right blend of innovative branch concepts.

- Banks are facing a trust issue in the digital world – FALSE. Trust in banks is nothing but an opportunity to offer secure proprietary apps and communicate the distinct value they add to customers’ lives, in order to reinforce mobile banking use.

Final thought: PSD2 will further accelerate the digital transformation and 78% banks plan to at least leverage the changes to open to new opportunities, if not even significantly benefit from the development. Moreover, half of these banks are looking to use PSD2 to develop an ecosystem with other partners.

We look forward to seeing you at SWIFT Business Forum Romania 2018! Thank you!

In Romanian:

Pentru informatii detaliate despre celelalte programe cofinantate de Uniunea Europeana, va invitam sa vizitati www.fonduri-ue.ro. Continutul acestui material nu reprezinta in mod obligatoriu pozitia oficiala a Uniunii Europene sau a Guvernului Romaniei. Proiect finantat in cadrul POC, Axa prioritara 2, Acțiunea 2.1, Prioritate de investitii 2b. Cod MySMIS: 115724, Nr. Contract Finantare: 101/16.08.2017.

Last week, we put together in Chisinau the first international conference linked to our most recent project for SMEs and corporate treasuries: FinOps Suite*. A major focus of this conference was to extend the FINkers United community in Moldova, one of the main goals of our project funded under the Competitiveness Operational Programme 2014-2020.

On October 26th 2017, the event unrolled by bringing on stage representatives of the main pillars of the financial and banking environment in both Romania and the Republic of Moldova. These amazing speakers helped us deliver a successful event for the audience formed by 90 decision makers and operations professionals from the local market.

We take this opportunity to give special thanks to the ones who accepted our invitation to join us on stage to share insights of their experience and a short history about the evolution of their institutions, lessons learned, current and future projects and things to look forward to, namely: the Romanian Banking Association, the National Bank of Romania, TransFonD, Eximbank Romania, the National Bank of Moldova, the Moldovan Banks Association, Victoriabank and Moldova Agroindbank.

Conference Highlights

- With regards to Basel II and III, the National Bank of Moldova is expecting to conduct a phased implementation, first deadline being July 2019.

- The role of the Moldovan Banks Association is to serve the interest of the banks, given the general context of the banking system reform, and Romanian experts have already trained bank employees on several topics, with help from MBA.

- The National Bank of Romania highlighted its 4 main focus areas: PSD2 (obviously), Directive 2014/92/EU on the comparability of fees related to payment accounts, Regulation (EU) 2015/751 on interchange fees for card-based payment transactions, and MiFID II (Markets in Financial Instruments Directive).

- The main projects of the Romanian banking community are centered around increasing the financial intermediation (crediting), the digital agenda and financial education.

- The Romanian Banking Association (ARB) also talked about introducing digital technologies, the role of innovation in the banking services and new technologies (blockchain), as well as instant payments services at the EU and Romanian level (ARB– TransFonD project in progress)

- TransFonD recommends a unitary adoption of standards in order to ensure interoperability and ease of processing.

- The Romanian State Treasury operations account for about 21% of Romania’s payments volume and they are successfully being processed by Allevo’s solution since 2005.

- One of the early FinTP adopters, Eximbank Romania, talked about making smart investments in technology: open source options, such as FinTP, that ensure transparency of code and, thus, enhanced security (the customer is able to audit and scan the code that runs in its back-office). They also presented how they ended up making the choice for FinTP and how their internal architecture is put together. It was a very down to earth and hands-on overview of how a bank operates from behind the scenes and how systems that need to flawlessly function at their best are designed and implemented.

- We announced our first banking customer in Moldova who has already adopted one of Allevo’s solutions, FMA, which helps them streamline operations and ensures a backup of the production environment and of the connection to SWIFT. We have been long present so far on the Moldavian market, delivering IT and consultancy services to local banks, but this is the first Allevo product we sold to one of these banks. We are very proud to add such a reference to our portfolio.

- One of the most prominent issues in Moldova, as well as in Romania, is the lack of workforce, and banks definitely feel it. It is closely followed by lack of technical resources, especially given the constant advance in technology. It’s difficult to keep the pace…

- Both local banks who made the honor of taking the mic, Victoriabank and Moldova Agroindbank, presented a high-level overview of the local market, what they expect from the regulator, projects they have in the pipeline and their strategy of addressing the financial inclusion issue.

- The National Bank of Romania advised Moldavian banks to not only expect regulations from the central bank, as those generally come in response to what is already happening on the market. Instead, it’s really important to approach self-regulation, in order to ensure a constant and early enough evolution.

- Business continuity is essential and major banks should be able to recover instantly! For example, in Romania, 5 banks total 70% of the payments volume. These systemic banks cannot suddenly disappear from the grid.

All in all, the October conference in Chisinau was, beyond doubt, one of the many key steps in promoting our FinOps Suite solution worldwide, as well as expanding the FINkers United community beyond borders, and we would like to thank everyone involved for making this possible. Already looking forward to our next endeavor…

*FinOps Suite is the business name of the software solution being developed within our Treasure Open Source Software (TOSS) project.

In Romanian:

Pentru informatii detaliate despre celelalte programe cofinantate de Uniunea Europeana, va invitam sa vizitati www.fonduri-ue.ro. Continutul acestui material nu reprezinta in mod obligatoriu pozitia oficiala a Uniunii Europene sau a Guvernului Romaniei. Proiect finantat in cadrul POC, Axa prioritara 2, Acțiunea 2.1, Prioritate de investitii 2b. Cod MySMIS: 115724, Nr. Contract Finantare: 101/16.08.2017.