The final day of Money20/20 came upon us and we had to say goodbye to charming Copenhagen, but not without taking in more pieces of wisdom and insights from all over the financial ecosystem.

After a debate on the power, potential and perils of personal data, focused on how regulation is actually driving innovation, we attended one on distributed ledgers, from proof-of-concept to real-world adoption, which also tackled the role of open source software in blockchain.

The on-site poll on DLT concluded that the biggest opportunity for it, in the long term, is cross-border payments, closely followed by KYC and identity, and trade finance (although we really-really appreciated the rebel voter for “saving the whales”).

Rita Liu, Head of EMEA at Alipay, nailed the main hurdle right now: “Disruption in the legacy systems requires time, money and devotion from the industry, a challenge that everyone needs to face.”

Legacy systems were also mentioned as a roadblock in Nuno Sebastiao‘s speech (CEO at Feedzai), but with a very practical side dish: “the nay-sayers of ‘Oh, it’s too risky, it’s problematic’. It’s NOT! It’s just evolution, creative destruction, the one that propels us forward into a different society. This is what enables, in the end, an open society, where people trade among countries, among geographies, with no barriers. That’s what we want to achieve.” Word!

“We’re all intertwined, we’re all part of the same big puzzle.”

– Nuno Sebastiao, CEO, Feedzai

– on collaboration

Nuno further underlined:

- “Initiatives like PSD2 and open banking will fundamentally transform the concept of brick-and-mortar bank that we had in the old days. Today, a bank is nothing more than an app that you use between multiple organizations, to do what you, as a consumer, want to achieve, which is essentially to transact.”

- “The providers of financial services are going to have to compete on customer experience, on what they can do for you, as opposed to ‘I’m gonna save your money and that’s good enough’. It’s not going to be good enough anymore.”

- “Do something that makes a difference. Don’t do yet another little thing […] Build something that you truly understand it’s going to help people. If you do that, there’s value there and people will recognize that.”

Picked up these vibes:

- Distributed ledger technology (DLT) is kinda like blockchain, but without all the bad stuff.

- Don’t design supercars in finance, you will find speedbumps on roads. Build a smooth infrastructure first, reach out to everyone and then go for excellence.

- We should learn from fraudsters who always share tips and tricks. We should share more to keep up with the bad guys.

Homework aka Food for Thought

How do you serve non customers and achieve financial inclusion?

All this API talk is about better experience for existing customers.

How to reach out to everyone?

Our second day at Money20/20 Europe was marked by a lot of optimism, energy and desire to make things better, as talks focused once again on collaboration, partnership and innovation, with a particular accent on user experience (UX), APIs, blockchain and PSD2.

Under the magic wand of Pat Patel, Content Director for Money 20/20 (Europe and Asia), the conference agenda was carefully anchored around 6 “theoretically simple things” (as he called them): why consumers and businesses spend, manage, save, borrow, share, and protect money.

Newcomers in the financial industry were advised by Jim McCarthy, EVP at Visa, to understand their core assets, as well as things others can provide: “you have to run at the speed of software and keep up with the pace of change that’s really driving this world as we know it. You need to learn to partner and figure out who can help you get there faster.”

Another helping hand came from Philippe Vallée, CEO at Gemalto NV, who underlined the need for everyone to be curious, agile and adaptive, since this ecosystem is evolving fast and it’s extremely important to stay open, tuned and understand the trends. He further defined the importance of collaboration in this industry as “a good recipe not to stay on the side of the road, by being influenced, challenged, in particular by millennials, young kids who have a lot of ideas about how to change, and therefor, a good way to stay in the race is to be open and listen to what’s happening around.”

Giulio Montemagno, General Manager at Amazon Pay (Europe), further stressed the importance of collaboration, as “innovation is very rarely acceded by one single company”. On the controversial topic of the changes we’re all facing, his point of view was extremely elegant and in line with our own beliefs, here at Allevo: “since the only constant is change, we need to constantly adapt, to lean into the future, to adapt our technologies, our services, and our businesses to the ever-changing condition.”

“At the end of the day, it’s all about humans. Software doesn’t meet each other magically.”

– Jim McCarthy, EVP, VISA –

on partnerships and collaboration

Gemma Godfrey, CEO at MOOLA: “The world has changed, the balance of power has shifted, that old way of working, of being locked in a room in an ivory tower thinking up the next idea to sell, is dead.”

Back to Philippe Vallée (Gemalto), this time on the crossroad between UX and security compliance: “Different technologies are coming into play to increase user experience, to make it more freed, less clingy, while not compromising with the security […] This industry is facing a lot of regulation, specifications to meet, to be compliant with, and we shouldn’t forget when designing a new product or launching new services about this sort of compliance we need to respect. The agility today and the technology we can use can help us comply without compromising the user friendliness.”

Customer Loyalty Has Changed:

P.V. (Gemalto): “I’m sure that FinTechs will sooner or later face the same challenge. This is why, as an industry, we need to keep enhancing the user experience, without compromising security. We need to offer at the same time loyalty AND trust.”

Last, but not least, on the topic of open banking and PSD2, there was an interesting debate on… wait for it… PSD3! Under the motto “This time we mean business”, UL Principal Consultant, Xiaodong Guo, talked about the inevitable – and fast approaching – bank (r)evolution. Talks further revolved around open banking as a concept, and PSD2 as a small part of it, the need for regulation in this field, as well as the benefits for the end user.

We must insist on the huge uncertainty still revolving around this directive, where banks still ask solution providers: “You are the experts, you tell us what to do!” This is why, in an on-site poll asking participants whether PSD2 is creating more questions than it answers, a vast majority agreed that it does, while a particular (and anonymous) intervention was greeted with giggles.

We’re sharing it with you below, to end our second day report on the fun side:

See you tomorrow!

After a bit of a hassle with a cancelled flight, Allevo managed to land in Copenhagen just in time for Money20/20 Europe, and we’re now bringing you “Day 1 Highlights” as seen through our lens.

Before diving into the engaging debates and interviews quoted below, we must say that representatives of banks and FinTechs alike agreed that the primary focus in the years to come should be on the customer and on the overall collaboration in the financial industry. We’ll raise a glass to that!

Now, let’s take a peek at the main topics and statements that have caught our attention:

“Collaborating within the industry is important because it really is the only way to push new ideas ahead. […] It’s critical that we reach outside, that we collaborate with others, that we embrace the external innovation.”

– Carlos Torres Vila, CEO, BBVA –

- “Through technology, we can help people make better decisions around money, providing them with peace of mind.”

- “What excites me about the future of banking is that we now have the ability to provide a magical experience, like self-driving banking, where people can really forget about their finances if they so wish, and the decisions will turn out to be the right ones for their particular situation.”

- “The biggest hurdles: we have increased regulation, negative interest rates, as well as the normal hurdles associated with innovation in a large corporation.”

- “People do not like banking. Millennials would rather go to the dentist than go to a bank. What’s even worse is that we don’t like to manage our finances, we don’t dedicate time to it.”

- “More than a third of people in the middle class don’t have the most basic financial habit, which is to save for an emergency.”

“It’s difficult to know where to place your bets, but it’s foolish to think you can do it all yourself. In this interconnected world, we need to collaborate.”

– Ashok Vaswani, CEO, Barclays UK –

- “With all the technology that’s virtually sitting in our pockets, we’re getting into a truly connected world, and finance underlines virtually everything we do.”

- “We have to deliver upon truly connected finance. How we do that and how we make it easy for our customers to deal with, that is what it’s really all about.”

- “Collaboration is really, really important. I don’t think that anyone can have a copyright on innovation. I have to go out and see what’s the best that’s going around the world.”

Also Caught our Ears

Jack Dorsey, CEO, Square:

- “We’re super excited about continuing to power people into the economy and enabling them to participate wherever they are, whoever they are and whatever their background.”

- “You don’t have to be first. You just have to be best.”

Mok Oh, Vice President, Samsung Electronics:

- “The 3 INs: Intelligence, Internet of Things, Interdependence.”

Mark Barnett, President UK & Ireland, Mastercard:

- “As a technology provider in the payments space, we have to go where our customers are taking us, and that includes to new ecosystems, such as AirBnB and other sharing economy.”

Before wrapping it up, we must say that the top trends in payments and FinTech were also revealed, but that’s such a generous and ardent subject that we’ve decided to dedicate a whole blog post to it, once this conference reaches the end and we get to sift through all the conclusions and wonderful ideas that keep springing up.

We’ll get back to you tomorrow with “Day 2 Highlights” from Money20/20 Europe.

In the meantime, feel free to follow our Twitter feed, to keep up to date.

Allevo attended the second edition of Money20/20 Europe, held in Copenhagen on 26-28 June.

This year, Europe’s largest FinTech event gathered over 400 speakers and thousands of FinTech & banking representatives from 1700 companies in over 70 countries.

Insights from the conference can be found on our blog.

Cyberattacks are becoming more and more prominent and the funds transfer arena is one of the preferred targets of such threats. Given the agility and evolution of these cyber threats, combating fraud on the long term is a challenge and a key prevention factor for the entire financial industry.

CSP Context and Principles

As SWIFT partner since 2003, Allevo sustains and promotes SWIFT’s initiative to launch the Customer Security Programme (CSP), which aims to improve information sharing throughout the financial community, enhance SWIFT-related tools and provide audit frameworks, while recommending best practices and guidelines for fraud detection. Being at the heart of the banking-financial industry, SWIFT is committed to playing an important role in reinforcing and safeguarding the security of the wider ecosystem.

The SWIFT Customer Security Controls Framework describes a set of mandatory and advisory security controls for SWIFT customers and addresses all entities that have an active BIC8. All controls are articulated around three main objectives:

- ‘Secure your Environment’ – SWIFT customers are individually responsible to protect and secure their local environments in general, as well as the back-office systems that come in contact with SWIFT applications in particular

- ‘Know and Limit Access’ – prevent and detect fraud in your commercial relationships – your counterparts

- ‘Detect and Respond’ – defend against future cyber threats.

Mandatory security controls establish a security baseline for the entire community, and must be implemented by all users on their local SWIFT infrastructure. SWIFT has chosen to prioritize these mandatory controls to set a realistic goal for near-term, tangible security gain and risk reduction.

Self-attestations must be submitted by the end of 2017, starting July, and in this endeavor, SWIFT will work in close partnership with the banking community, to ensure everything goes as smoothly as possible for all parties involved.

CSP actions include the introduction of 16 mandatory security controls, new services meant to help prevent and detect fraudulent activity, as well as community-wide information sharing initiatives that prepare for, and defend against, future attacks.

The 11 advisory controls are based on good practice that SWIFT recommends users to implement. Note that some of them may in time become mandatory as well, due to the evolving threat landscape. Since nothing beats being prepared ahead of time, you should also consider these advisory aspects once all the mandatory requirements are met.

CSP and SWIFT’s 2020 Strategy

CSP is a multi-year programme, whose measures should become part of everyday practice, and although clear delivery milestones have been defined, there is no definitive end to this programme, as levels of security should constantly heighten in order to stay ahead of emerging cyber threats.

As far as SWIFT2020 is concerned, you may already be aware that it focuses on operational excellence in SWIFT’s core financial messaging services in order to deliver on the highest expectations of customers, in terms of security, reliability and availability of service, while also addressing new cyber and geopolitical challenges.

Considering the role SWIFT plays as an industry-wide cooperative, CSP not only fits like a glove for this long-term strategy focused on security, but is quite a natural extension of it.

The Bigger Picture

Besides these security controls, SWIFT has also introduced enhanced security features to their products, designed to assist users in addressing security concerns, such as stronger password management, enhanced integrity checking and built-in two-factor authentication.

SWIFT is not only concerned with banks per se, but the entire ecosystem revolving around them, and banks should also care about breaches of security outside their walls, on their counterparties’ side.

Part of what SWIFT can and will do on this matter is to keep banks up to date with relevant cyber intelligence, and to continue to expand their information sharing platforms. SWIFT is engaging with vendors and third parties to help secure the broader environment, but banks should also act in a timely manner on SWIFT information and security updates, of course.

After all, this whole hassle is for the greater good of keeping everyone’s finances safe…

*Article based on information found on SWIFT’s website.

Tired of hearing about banking disruption? You’re not to blame, it’s a scary term feeding off a mound of vulnerabilities and it’s been flooding the media lately.

Are FinTechs the Big Bad Wolf?

Banks are increasingly often portrayed as if walking with a dark cloud dubbed FinTech over their heads, threatening to rain on their parade, but is this truly the case? We at Allevo think more in terms of partnerships and, as you already know, that is a two-way street, with advantages and benefits for both sides.

In fact, while FinTech companies are generally thought to be on the lookout for the next opportunity to take a bite and shrink the relevance of today’s banks, we think this is not the case. FinTechs by definition cannot compete with banks and can only succeed as long as a healthy banking environment exists. FinTechs and banks need to coexist and use each other to provide better services to people. We at Allevo have historically positioned on the side of the banks and we are offering to help them create better (and cheaper) services that can expand customer reach. We do this by promoting banking on open source technologies.

Now more than ever, with so many changes ahead of us (featuring PSD2 as queen bee), “collaboration” should be the key focus of the relationship between financial services and technology industries and we’re ready to embark on this journey with you by our side.

It’s only together that we can maintain and grow value, through openness and constant innovation, and our experience, ideas and energies combined are meant to deliver better products for everyone.

Gliding on the Winds of Change

We’re not ones to indulge on motivational quotes, nor are we going to preach that change is good, but something William Pollard said over a century ago caught our eye. Are you thinking about the classic “Without change there is no innovation, creativity, or incentive for improvement”? Well, that’s just a plain starting point. It’s what he said next that truly makes a difference, that is: “Those who initiate change will have a better opportunity to manage the change that is inevitable”.

We’re part of a very lively system, always striving to be one step ahead through constant analysis and trend forecasting. And so should you. After all, who else could be better prepared for a change than its very initiator?

Fun fact: Although Jurassic Park was still trending when Bill Gates called retail banks “dinosaurs” back in 1994, little did he know that instead of becoming extinct, they could rise from ashes.

It’s already proven that progress is achieved when fear of change gets replaced with the desire to seize new opportunities. So, to all the skeptics out there, please know that there is a silver lining to every change, no matter how terrifying it may seem at first. Oh, and we’re here to help, not to feast on misfortunes.

The big picture of microfinance is about loans, money transfers, insurance and, in some cases, deposits, just like in the “normal world”. But all the differentiating details eventually create a very specific need, and that must be addressed accordingly.

What Does Microfinance Stand For?

Though its history can be traced back to the 1800s, microfinance first gained prominence during the 1970s and is nowadays considered a tool for socio-economic development, meant to reduce income inequality, by allowing citizens from lower socio-economical classes to participate in the economy.

Microfinance institutions (MFIs) serve different clienteles than banks, mainly people who have little access to regular banking services and who need to make frequent small value loans. Hence, compared to banks, MFIs capture other aspects of financial development, also having a different impact on poverty alleviation, and often serving rural communities, especially in developing countries, where banks have little to no presence.

This, in turn, leads to distinct needs that must be addressed separately, through customized (and customizable) products and services.

How Can Allevo Help Microfinance Institutions Strive?

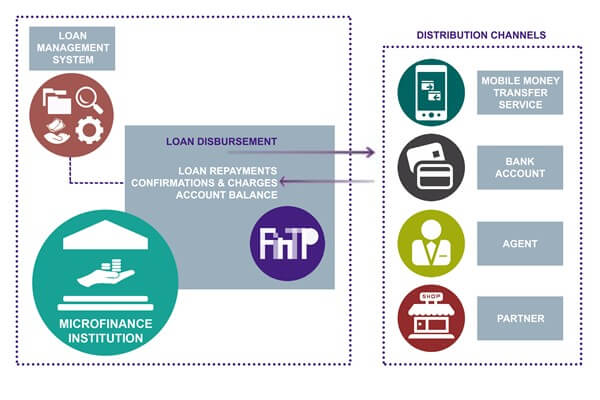

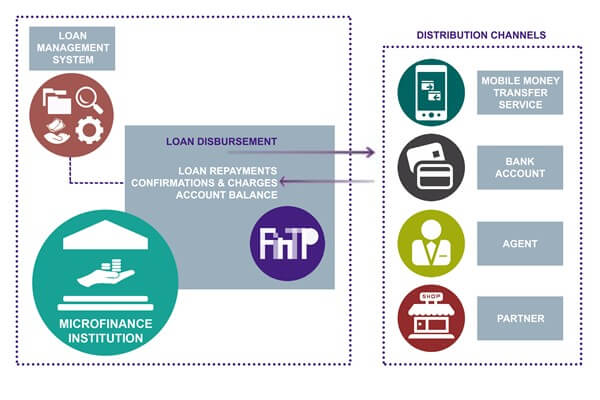

Allevo’s Operations Management solution for microfinance institutions offers flow automation, compliance to standards and integration with banks on one side and various distribution channels like mobile money transfer operators on the other.

FinTP retrieves loan disbursements from the internal systems of an MFI, converts them into the ISO 20022 internal format and prepares them to be sent to the intended distribution channel in the specific format – APIs, database, XML or agnostic files etc.

The business flow is fully automated, allowing operators to have an instant view on intraday activities and take action in outstanding situations.

In terms of integration, FinTP connects to internal loan management systems, accounting and customer databases and fetches disbursements ready to be sent to any type of distribution channel:

- agent network

- partner network

- mobile money transfer (MMT) services

Disbursements can be split into multiple sub-transactions of a predefined maximum amount to lower risk on one hand, and to ensure they can be processed by the distribution channel on the other. In most cases, this limit is a requirement imposed by the MMT and it is the for compliance purposes.

Loan repayments are automatically matched to existing outgoing disbursements. If a match cannot be made, they are labeled as outstanding payments that need to be investigated by the operator.

System and network confirmations are automatically attached to the original outgoing disbursement, allowing for the operator to see the status of a loan at any given point in time.

Any incoming charges or fees are processed and sent to internal back-office or accounting systems.

FinTP also filters disbursements, ensuring that no duplicates are being processed and sent to external systems, and it has the capability to cross check the beneficiary against custom black or white lists (credit scoring, anti-money laundering, anti-terrorist regulations).

These being said, should you play a role in an MFI aiming for constant improvement, why not give our solution a try?