Allevo was one of the proud participants at the closing event of the Twinning project “Strengthening the National Bank of Moldova’s capacity in the field of banking regulation and supervision in the context of EU requirements”.

According to the information published by the National Bank of Moldova on their website, this project was launched on June 30th 2015 and has now reached the end of its 2-year implementation period. On this journey, the National Bank of Moldova had the full support of a consortium consisting of the National Bank of Romania and De Nederlansche Bank.

The official closing event dedicated to the Twinning project was held on May 30th 2017 in Chisinau, and gathered high-ranking dignitaries, ambassadors of the European Union, official representatives from the National Bank of Moldova, the National Bank of Romania, as well as numerous experts from the banking community.

Not long ago, a similar event took place in Bucharest, and recent findings showed that the project implemented by the National Bank of Moldova led to pretty conclusive results.

During these 24 months of technical support, a number of 56 activities took place, involving 48 experts from the National Bank of Romania and De Nederlansche Bank. These activities encompassed 665 working days and 106 missions in the Republic of Moldova, Romania and the Netherlands, gathering 50 experts from the National Bank of Moldova, 11 banks, and over 100 representatives from the banking community.

Major results were obtained by employee training, exchange of experience with foreign experts, impact studies, as well as other evaluations.

Open banking around the world / Responding to money laundering 101

We kicked off this week at a conference held by Wall-Street.ro at Sheraton Hotel Bucharest, under the sign of “Digital, the New Black in Banking”.

Day 1 – Cybersecurity + Digital Banking + UX for Financial Institutions

After a high-level keynote speech on the cybersecurity landscape by Sebastien Kucharek, head of Treasury & Trade Solutions CEE at Citi, Aurelia Costache from EY Romania presented the results of last year’s Global Consumer Banking Survey, highlighting the fact that trust remains a key concern for banks.

This reminded me of something that I came across recently and would now like to share with you: “Institutions develop because people put a lot of trust in them, they meet real needs, and they represent important aspirations. Whether it’s monasteries, media, or banks, people begin by trusting these institutions, and gradually the suspicion develops that actually they’re working for themselves, not for the community.” (Rowan Williams – Fellow of the British Academy)

The second panel of the day focused on the user experience (UX) for financial institutions, with a highlight from Alexandru Pavelescu – UX Architect at ING – who dubbed FinTechs as “a fountain of education and knowledge” for banks to tap into. His speech was backed up by Alina Catalina Banuleasa – UX Designer at Electronic Arts (EA) – who further stated that, in order for banks to keep the pace and be competitive on the market, they should establish high-budget divisions specialized in digitalization.

The second panel of the day focused on the user experience (UX) for financial institutions, with a highlight from Alexandru Pavelescu – UX Architect at ING – who dubbed FinTechs as “a fountain of education and knowledge” for banks to tap into. His speech was backed up by Alina Catalina Banuleasa – UX Designer at Electronic Arts (EA) – who further stated that, in order for banks to keep the pace and be competitive on the market, they should establish high-budget divisions specialized in digitalization.

The word that came across most often during the user experience debate was “empathy”, as an expression of the necessary joint effort of all teams in a company to respond to users’ needs and expectations.

We at Allevo fully resonate with this and, even though our product is a middleware, thus not providing a direct interaction with the bank’s clients, we do care about the app users! We strongly believe in constant development and this is why we always encourage our partners to send feedback, in order to enhance their user experience.

So, let us take this opportunity to invite you once more to share feedback on the functionalities you’re currently using…

Day 2 – Financial Inclusion: Legislation Setbacks and Triggers

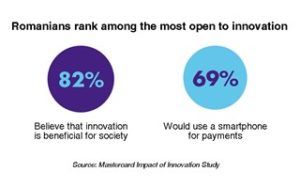

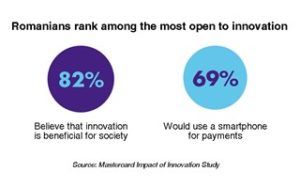

The second round of Future Banking, this time on “The Next Station of the Contactless Journey”, featured a special panel dedicated to PSD2 and open banking that many of us eagerly expected. Happily, the foregoing presentations were no less, with really innovative products presented by Mastercard and, our favorite, Revolut.

The “Financial Inclusion” panel debated on the recent cash-back legislation and on the importance of financial education in Romania, particularly in the rural areas, where cash is king and, generally, not subject to taxation. The good news is that many opportunities await ahead as there is more than enough space to grow, given that all parties involved are willing to make an effort.

On this topic, the National Bank of Romania representative, Ruxandra Avram, strongly advised all banks to fast-forward the implementation of instant payments, so that they wouldn’t lose clients/market share when PSD2 becomes effective. Moreover, a new helpful report from EBA is available as of May 5th on Regulatory Technical Standards (RTS) and Implementing Technical Standards (ITS).

Rodica Tuchila, representing the Romanian Banking Association, explained implications of PSD2 and where discussions currently stand in Romania. She pointed out that a national standard for APIs is being discussed in Romania, in line with the approach of other countries for PSD2. She also brought screen scraping back into discussion, emphasizing that it is and should not be allowed. So, those FinTech providers who use this technology should rethink their platforms in order to avoid this practice and comply with the provisions of PSD2.

The thought of the day was that small steps are being made in the right direction when, in fact, we should all accelerate the pace. These being said, we encourage banks to plan a meeting with us on PSD2. We wouldn’t want anyone to be caught off guard and, I don’t know if you’ve noticed, but time flies by really quickly…

Certain crimes generate large amounts of “dirty” money that needs to be cleaned to seem derived from legal activities, so that banks and other financial institutions would deal with it without suspicion.

(Anti) Money Laundering Timelapse

Believe it or not, money laundering regulations date back to 2000 BC, when Chinese merchants used to hide their wealth from rulers by investing it in remote provinces or even outside China.

It didn’t take long for real offshore banking and tax evasion to develop, since many states decided to impose rules for confiscating the citizens’ wealth. One of the most notable informal value transfer systems still in use today is that of hawala, especially in the Middle East and North Africa.

The 9/11 attacks assigned new priorities for money laundering laws that would combat terrorism financing and, starting in 2002, governments around the world increased surveillance and monitoring of financial transactions.

The latest iteration of the EU’s anti-money laundering directive (AMLD IV) became effective June 25, 2015, with a 2-year window for implementation, in an attempt to get more in line with US requirements, since the lack of harmonization between these two affected financial institutions operating in both jurisdictions.

Who Should Comply and How?

Current AML regulations apply to all credit and financial institutions, private pension funds, casinos, auditors and, under certain conditions, to public notaries, lawyers, service providers, real estate agents, as well as other natural or legal persons trading goods or services for total cash transactions of minimum 15 000 EUR.

Starting with AMLD IV, more public officials are brought within the scope of the directive, as well as the entire gambling sector. Moreover, EU member states have to establish new registries of “ultimate beneficiaries”, whilst the payment threshold is lowered to 10 000 EUR.

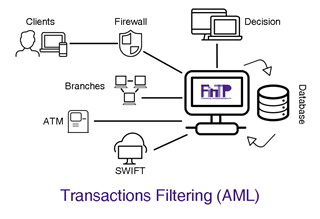

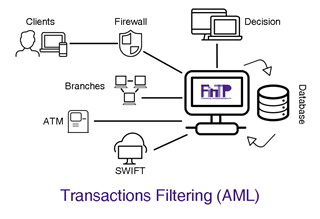

The broad range of risks has to be tackled efficiently by incorporating a special filtering function in the transaction processing solution, and we guarantee you that the most cost-effective software of this kind is the open-source FinTP, whose AML filtering feature has received the FinMedia e-Support Award in 2010.

Take a Peek at What We Have to Offer

The Transactions Filtering feature of FinTP identifies the inter-banking payments that present a high CFT (Combating the Financing of Terrorism) infringement risk, offering the possibility to analyze them and to make the appropriate decision of authorizing or rejecting the payment, before the actual funds transfer.

The application provides message filtering with detection of possible money laundering transactions, for both high and low value payments for various types of instructions, such as:

- Payment instructions received/sent via SWIFT network: MT103, MT103+, MT202COV

- Payment instructions received/sent in relation with an automated clearing house, like SEPA standard format (pacs.008, pacs.004), or proprietary message structures (CoreBulkcreditTransfer)

- Other instructions corresponding to financial instruments like cheques, bills, promissory notes.

Besides preventing the risk of financing terrorist activities, this feature also assists banks in meeting the regulatory requirements of both local and international legislation related to the sensitive compliance aspect, while compiling different types of sanctions lists and offering a complete set of reports and statistics.

The message filtering functionality works online, in real time, against over 20 black lists, including official international sanctions lists, as well as the bank’s internal lists. Filtering lists are chosen and uploaded by the user, with automated or manual upgrade or update options, completely independent from the solution provider.

Please know that we’re here to help you comply and we strongly believe that you too should benefit right away from enhanced protection of fund transfers!

The second panel of the day focused on the user experience (UX) for financial institutions, with a highlight from Alexandru Pavelescu – UX Architect at ING – who dubbed FinTechs as “a fountain of education and knowledge” for banks to tap into. His speech was backed up by Alina Catalina Banuleasa – UX Designer at Electronic Arts (EA) – who further stated that, in order for banks to keep the pace and be competitive on the market, they should establish high-budget divisions specialized in digitalization.

The second panel of the day focused on the user experience (UX) for financial institutions, with a highlight from Alexandru Pavelescu – UX Architect at ING – who dubbed FinTechs as “a fountain of education and knowledge” for banks to tap into. His speech was backed up by Alina Catalina Banuleasa – UX Designer at Electronic Arts (EA) – who further stated that, in order for banks to keep the pace and be competitive on the market, they should establish high-budget divisions specialized in digitalization.