A complete open source solution that achieves connection to SWIFTNet and compliance to standards

Garanti Bank Romania continues to grow rapidly on the Romanian market. As such, the financial institution decided to optimize its operations, in order to offer better services to its customers. In 2017, Garanti Bank Romania selected Allevo open source solution to connect to SWIFTNet and ensure compliance to SEPA standards and regulations.

By adopting FinTP, Garanti Bank Romania benefits from a technology that drives cost reduction and conveys full control over the source code of the application, thus eliminating the common vendor lock-in dependence, while gaining access to a transparent product development process and transparent product audit.

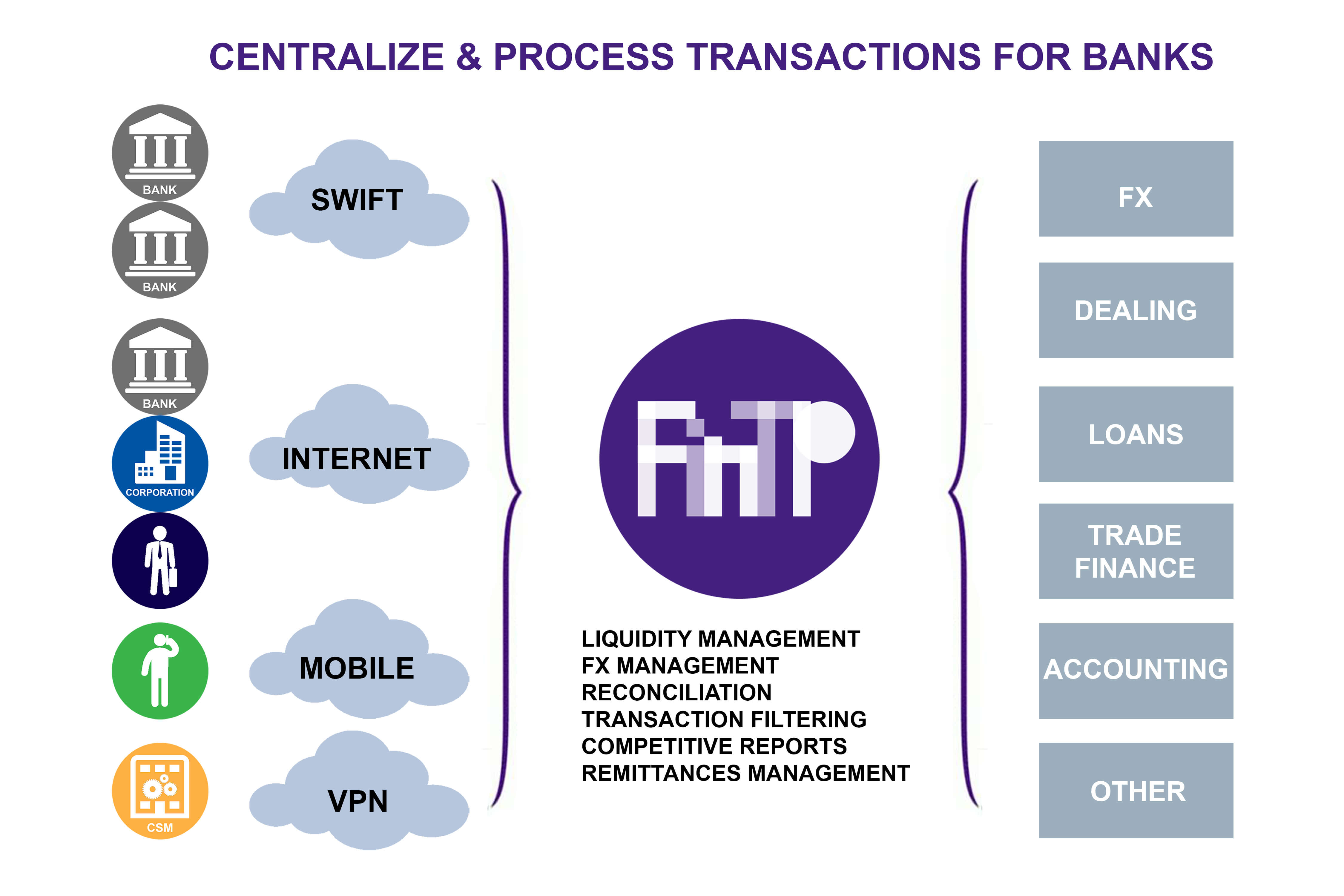

FinTP achieves technical integration between various business applications, connecting back-office systems of banks to external market infrastructures. FinTP comes with an embedded routing mechanism that redirects messages based on rules and content. It achieves message processing by initially mapping any proprietary or SWIFT FIN or XML messages to the native ISO 20022 message type, followed by applied the agreed business rules for sending or receiving. FinTP provides reconciliation and advanced capabilities for payment search and reports. The underlying technology offers persistent end-to-end transactions and multi-threading capabilities, not to mention a reliable security component, including management of groups and users, profile, functions.

“Garanti Bank Romania is constantly concerned with keeping its IT infrastructure up to date, to ensure we maintain the quality of services our bank’s customers are used to receive. We believe IT is not a one-time investment, but a process that needs a sustained effort to ensure customers get the very best. FinTP offers the flexibility to design our business infrastructure in line with our strategy”, declared Fatih Arpas – ICT Director, Garanti Bank Romania.

FinTP is distributed under the free GPL v3 open source license. This distribution model is different from what vendors in this industry practice, its main advantage being that it removes any dependence on the vendor.

“We chose Allevo, not only based on reputation and quality, but also because of the open distribution model, which was not provided by other vendors. The GPL v3 licensing frame brought Garanti Bank Romania full control over the source code of the application.”, Mr. Arpas mentioned.

“The collaboration with Garanti Bank Romania was extraordinary. Once all details were set and requirements were made clear, both the bank’s and our team joined efforts to implement this solution in a record time of 3 months, which, given the complexity of the business flows and overall architecture, is a real achievement. We at Allevo are very proud this is another example the open source distribution model we practice is not only attractive, but also fit for this industry.”, says Sorina Bera, Allevo CEO.

| A complete open source solution that achieves connection to SWIFTNet and compliance to standards

Garanti Bank Romania selected FinTP, Allevo’s open source solution to connect to SWIFTNet, ensuring compliance to SEPA standards and regulations, in order to optimize its operations. The bank continues, as such, to grow rapidly on the Romanian market, offering better services to its customers. |

|

By adopting FinTP, Garanti Bank Romania benefits from a technology that drives cost reduction and conveys full control over the source code of the application, thus eliminating the vendor lock-in dependence, while gaining access to a transparent product development process and transparent product audit.

FinTP achieves technical integration between various business applications, connecting back-office systems of banks to external market infrastructures. FinTP comes with an embedded routing mechanism that redirects messages based on rules and content.

It achieves message processing by initially mapping any proprietary or SWIFT FIN or XML messages to the native ISO 20022 message type, followed by applied the agreed business rules for sending or receiving. FinTP provides reconciliation and advanced capabilities for payment search and reports.

The underlying technology offers persistent end-to-end transactions and multi-threading capabilities, not to mention a reliable security component, including management of groups and users, profile, functions.

“Garanti Bank Romania is constantly concerned with keeping its IT infrastructure up to date, to ensure we maintain the quality of services our bank’s customers are used to receive. We believe IT is not a one-time investment, but a process that needs a sustained effort to ensure customers get the very best. FinTP offers the flexibility to design our business infrastructure in line with our strategy”, declared Fatih Arpas – ICT Director, Garanti Bank Romania.

FinTP is distributed under the free GPL v3 open source license. This distribution model is different from what vendors in this industry practice, its main advantage being that it removes any dependence on the vendor.

“We chose Allevo, not only based on reputation and quality, but also because of the open distribution model, which was not provided by other vendors. The GPL v3 licensing frame brought Garanti Bank Romania full control over the source code of the application.”, Mr. Arpas mentioned.

“The collaboration with Garanti Bank Romania was extraordinary. Once all details were set and requirements were made clear, both the bank’s and our team joined efforts to implement this solution in a record time of 3 months, which, given the complexity of the business flows and overall architecture, is a real achievement. We at Allevo are very proud this is another example the open source distribution model we practice is not only attractive, but also fit for this industry.”, says Sorina Bera, Allevo CEO.

The latest buzzword in FinTech is without a doubt “open banking”, but whether or not this becomes a lasting concept depends on a plethora of factors.

First of All, What Does Open Banking Mean?

A wiki stub may be all you need to put a name to “the use of open APIs that enable third party developers to build applications and services around the financial institution, greater financial transparency options for account holders ranging from open data to private data, and the use of open source technology to achieve the aforementioned”. And that name is… open banking.

Who’s Talking About Open Banking?

The biggest craze is, by far, in Europe, and that’s the doing of PSD2, but while EU’s changes in banking regulations were still being drafted, the UK jumped the gun establishing the Open Banking Work Group (OBWG), in September 2015.

Its purpose was (and still is) to analyze how data could be used in order to help everyone easily transact, save, lend, borrow and invest. In fact, it set out a standard for creating, sharing and using open banking data that we’ll definitely hear plenty about.

Where does the rest of the world stand in this picture? Here are some clues:

- “Monetary Authority of Singapore takes step towards open API architecture to bolster Fintech push” – 31 March 2016 (Channel News Asia)

- “South Korea is launching an open banking platform” – 13 August 2016 (Business Insider)

- “Brazil‘s Original Bank scoops ‘Most Disruptive Innovation’ award” – 31 October 2016 (EFMA)

- “Iran‘s first open banking API launched” – 7 January 2017 (Financial Tribune)

- “Canadian authorities jump on open banking bandwagon” – 2 March 2017 (Payments Compliance)

- “Japan‘s biggest bank to open banking processes to FinTech app developers” – 6 March 2017 (CryptoCoins News)

Surprise, Surprise!

Still, Europe’s quasi-antipode, Australia, is probably the most surprising in the matter. How so? Well, the Australian House of Representative Standing Committee on Economics filed a report in November 2016 regarding future banking regulations imposed by what they called “the oligopoly of Australia’s banking sector”.

In short, the Committee reviewed the four major banks in Australia and came to the conclusion that competition must be improved. The steps recommended in this matter include, among others, the launch of a Banking Tribunal and the creation of a data sharing framework for consumers’ and small businesses’ data.

EU stands by what Australia managed to explicitly state, but does so with velvet gloves, since it is a delicate matter and banks are highly uncomfortable with this emerging concept. But the truth is… beating around the bush doesn’t do anyone any good. So let’s set sail!

After all, this whole open banking concept is in line with what Allevo first had in mind in 2011 when we spread the word that we intended to migrate to a more open business model. What we tried back then was to anticipate the evolution of the main actors in the financial ecosystem (whether vendors, banks or SMEs) and keep up with their pace. To this we say “so far, so good”.

Experts agree that in order to minimize the amount of work involved, it is good practice to carry out bank reconciliations on a daily basis, preferably assisted by specialized accounting software.

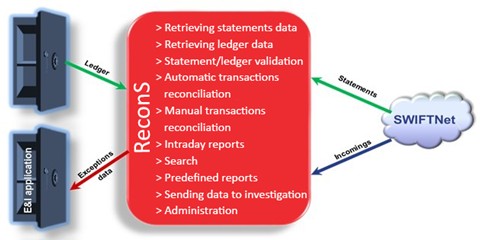

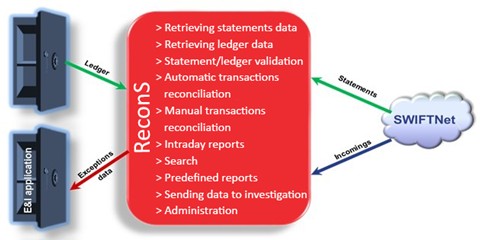

FinTP’s ReconS feature provides real-time automated / manual reconciliation of incoming or outgoing payments with bank statements. Not only does it lead to more timely reactions to risks, thus contributing to standards improvement and manual effort reduction, but it also helps reduce the overall cost.

In fact, here is a brief list of characteristics, which we may further expand upon request, especially since ReconS is also available as a stand-alone product:

- Ledger vs. statement reconciliation (NOSTRO)

- Payments vs. statement reconciliation (VOSTRO)

- Automatic or user-driven reconciliation

- Intraday liquidity reports

- Investigation features

- Rich set of reporting templates for a thorough operations control

|

|

1. Ledger vs. Statement Reconciliation (NOSTRO)

ReconS reconciles NOSTRO SWIFT statement and general ledger (GL) items and provides “offered”, “suspended” and “confirmed” matching functionality depending on the percentage of the satisfied criteria.

High-quality matches can be confirmed automatically, while others are submitted to the operators, in order to make an informed decision (suspend, confirm or unmatch).

2. Payments vs. Statement Reconciliation (VOSTRO)

ReconS also compares SWIFT payments vs. VOSTRO statements reconciliation, offering the possibility to check the quality of the statements delivered to customers.

3. Automatic or User-driven Reconciliation

The app automatically prompts operators to confirm the reconciled transactions based on a combination of criteria defined when configuring the system.

Certain confirmed transactions from the current session or from the transactions history can be reactivated in order to be corrected.

4. Intraday Liquidity Reports

ReconS monitors the balance in NOSTRO/VOSTRO accounts and checks whether the limit exposure is exceeded for accounts, accounts groups, or currency types, using a variety of SWIFT messages.

It also makes forecasts based on the information in: the statements received from SWIFT, NOSTRO accounts transactions, and total amount of the payments about to be performed, reporting the status of the unreconciled transactions, consolidated on various currencies.

5. Investigation Features

Identifying the unreconciled transactions, ReconS offers the possibility to either suspend them for further investigations, or to insert an explanation and to print these matches.

It also gives the user the possibility to point out or assign (in electronic format) the unconfirmed transactions to other applications/departments or users for further investigation.

6. Rich Set of Reporting Templates for a Thorough Operations Control

Reports in ReconS can be generated based on various criteria, like account, currency, bank, currency date, or booking date, as well as a combination of these.

Besides reporting the available and booking balance separately on each account and globally on all accounts, the app also reports the manually confirmed matches, detecting the ones that were incorrectly confirmed with a different currency date.

Other predefined reports are available, along with the possibility to define customized reports for monitoring the user activity in order to optimize operations.

Why ReconS?

First of all, it addresses the problem of identifying and managing the exceptions (reconciliation problems that cannot be automatically solved using the defined business rules), highlighting the data that has failed to be automatically matched and proposing solutions to facilitate the operator’s decision.

| Incorrect SWIFT messages are quickly detected for immediate clarification and the amounts under investigation are kept under control in order to promptly solve them. At the same time, the balance is accurately established according to the currency date and incorrect registrations are eliminated. |

|

Last but not least, endowed with a powerful reporting and query engine, ReconS allows users to extract any information in order to run a comprehensive analysis of accounts and matching information, by means of a user-friendly graphical interface.

This multi-platform product works both in Unix/Linux and Windows environments, offering connectors for SWIFT interfaces and GL applications, and supporting both SWIFT FIN and ISO 20022 message standards, as well as various data sources and formats.

If you don’t already know us, let’s start by saying that we’re a software company aimed at helping financial institutions thrive by providing them with open-source solutions for processing transactions.

We’re dedicated professionals and we’re definitely looking for the same as far as our clients and employees are concerned. Oh, and we’re cool, of course, but we’ll let you find that out for yourself. Anyway, enough about us… where would YOU fit in?

Best Case Scenario

Got work experience? Here are April’s openings at Allevo:

Second Best Case Scenario

Perhaps you are a Computer Science student or graduate who is willing to learn something for real? We’re great at internships too…

In fact, we are currently looking for a Tester and a .Net Developer.

Do you think you can fill these shoes? Send your CV and let’s find out together!

Third… You Get IT

Couldn’t find anything you fancy, but you’d really like to join our team?

We’ll be more than glad to help. Just let us know what you’re looking for and we’ll see what we can do.