Monday, March 24, 2014

First time I saw a “for Dummies” brochure, I found the expression a bit offensive. Even now, I thought twice whether to name this text “for Dummies” or “FINkers United ABCs”. But reading that first brochure I understood the value of it: having things explained, plain and simple, common language, without all the metaphors or exaggerated sales propaganda; having a concise, straight answer to the questions that can pop-up in anybody’s mind.

So that’s what I want do for FINkers United.

Chapter 1: General Aspects

What is FINkers United?

FINkers United® is an open source community for all financial thinkers’ enthusiasts – from IT developers to financial experts – gathered around the FinTP® Project.

PS: this also answers another question: where does the name come from? Well, from financial thinkers united.

What is FinTP?

FinTP is an open source financial transactions processing application meant to be used as an open platform in a strictly regulated market.

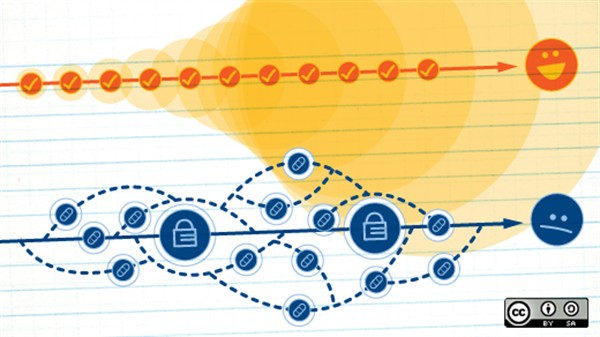

FinTP aims to push financial transactions interoperability forward – from the current message syntax standard layer towards transactions interpretation – thus attaining a higher semantic standardization layer.

What is the purpose of this community?

It’s to encourage creativity in the financial industry, to create an environment where ideas are seeded and brought to ripeness to the benefit of all. It is aimed at freeing people’s creativity and brains from reinventing the wheel, as it happens in a closed traditional environment, and allowing them to take advantage of all the benefits an open approach brings.

In fewer words, it aims to grow the FinTP application that Allevo has provided the code for through contributions at any level, from requirements to be implemented to various operating systems compatibility, support applications and so on.

Who can become a member?

Anyone who has an interest in this area, likes the idea, is passionate about developing in open source or is keen in taking part in building an innovative product may become a member. All you need to do is register on www.fintp.org. Actually, there is no community if it does not have purpose and this is given by its members.

All of you are welcome to our community, to use our code, to praise or criticize us, and give us feedback. Users who continue to engage with the project and its community will often become more and more involved. Such users may find themselves becoming contributors.

What is a contributor?

Contributors are community members who wish to take part in concrete ways in the community running. Their contributions can take many forms, but all are to be submitted as patches that should be validated by committers or project maintainers.

The types of contributors are detailed in Chapter 2: Structures and roles, together with how you can contribute, how your role can grow in the community and what’s higher up the chain.

If I do not have technical skills, could I still be part of it?

But of course you can. Any idea is welcome and any member’s knowledge is valuable to the community. For example, you might have an idea of a feature or new project you think is useful and worth adding over FinTP.

You can also contribute by sharing your expertise in discussions on the Forum, the designated space for all debates within the community. All contributions will be acknowledged and thanked for.

Oh, but where can I find the code?

We used the GitHub portal as the repository for the FinTP source code. But you can also find the binaries on the community’s web page, www.fintp.org.

It sounds interesting. Where can I read more about this?

On www.fintp.org, the community’s portal. You can read about governance, structure and roles, meritocracy, voting, code of conduct and so on. And there are a lot of topics that might interest you on the forum.

Stay tuned for the following chapters of FINkers United for Dummies. We will explain the structure of the community, how exactly you can contribute, the roles you can have and of course, how the community really works, in terms of processes, activities and teamwork.

By Ioana Moldovan, 24 March 2014.