This year’s SOFE (SWIFT Operations Forum – Europe) was organized in London, between the 29th of November and the 1st of December.

Excellent opportunity to learn about SWIFT’s accomplishments&events in 2011 and to be informed about SWIFT’s plans & projects for 2012 – products and services, future developments and strategies.

A distinct theme in this year’s SOFE was INNOVATION.

Innotribe, the SWIFT’s initiative on innovation, was one of the main subjects on this year’s agenda. The Innovation Plenary, having the eloquent title “The Sandbox and The Castle”, was followed by no less than three interactive workshops, highlighting the importance this initiative.

The video summary of this Innotribe event is here (and you’ll probably recognize Allevo’s delegates, members of the Innotribe Group).

We’re proud to have been presenting to an important audience at IDC’s Conference the benefits of a centralized payment solution.

Our speaker, Mrs Cristina Cioroboiu, business analyst, held an interesting and very well received presentation to the representatives of the Utilities and Energy Industry.

Cristina Cioroboiu’s presentation

Yesterday we held the 19th edition of this event dedicated entirely to our customers.

The agenda consisted of 5 topics. The first, presented by Allevo’s Professional Services Director, Sorina Bera, was a report for qPayIntegrator’s support services. She conducted a complete analysis on the issues raised by our customers in 2011, taking into account different criteria like the platforms on which they occurred, the severity, the time for response and so on.

Key points of her speech were 1. speeding up the acceptance testing for the patches delivered by Allevo on the customers’ test environments and 2. historic cases. The ideal case is when these patches are promoted on the live environment in less than 60 days. Also, historic cases are to be reevaluated on both sides and each of Allevo’s customers will receive during the following week a full report customized for their own institution.

Next point of the agenda was presented by Allevo project manager, Andreea Darlea. She announced the release of qPayIntegrator 3.0 in April 2012. The v 3.0 release means upgrading to Oracle 11g & WMQ 7 and the qPI-SEN functionality, namely the SCT / RON business flow (SEPA credit transfer on RON). We will deliver this release of qPayIntegrator to all our banking customers, which means there will be a thorough testing of all business flows.

Then after, our new business analyst, George Marcu, outlined qPayIntegrator’s new functionality set for banks: Target2, treasury, statement, SEN (SEPA Romania); and also for corporations.

Then after I presented the competences achieved by Allevo and its team members in 2011. We counted an impressive number of 46 certifications, on top of those we already had:

- 1 at company level (ISO 9001:2008 recertification)

- 1 at application level (SWIFTReady Workers’ Remittances 2011)

- 6 for SWIFT Alliance, Gateway & SNL, all v 7.0

- 28 IBM on several products

- 6 database (3 Oracle 11g & 3 SQL Server)

- 4 others (Linux, project management etc)

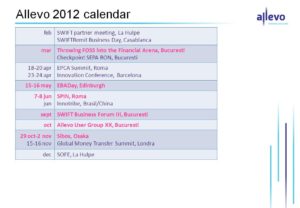

Afterwards I outlined the 19 events of 2011 Allevo has either organized, sponsored or simply participated at, excluding other types of dinner events, award ceremonies, partner events and so on and so forth. To wrap the following slide up, we had 12 participations abroad, 8 with stand & product demos and 10 with speech within a conference. We’ve been very active in remittances conferences & workshops, we’ve changed our visual identity becoming Allevo, we’ve marked the 4th consecutive participation as exhibitors at Sibos and the only 2 gigs awaiting us this year are SOFE in London and our most expected Christmas party, marking down the end of a terrific year.

For 2012 we have in mind 14 events, the ones foreseen so far, the most interesting of which (except for Sibos, of course) is “Throwing FOSS into the Financial Arena“. We intend to organize this as a round-table event where we are going to invite key persons who are going to create a very interesting debate on the way free and open source software can penetrate this very rigid financial industry.

These event lists were followed by a short overview over Allevo’s online presence – the new website launched this June, the blog, the Facebook page, the LinkedIn page, the Google+ page and the Twitter stream. Oh, and, speaking of Facebook, don’t forget to check out the photo album of yesterday’s event.

Concluding this section of the agenda, I revealed what we have in mind for 2012: continuing the branding process at product level (the well known Esfera, FMA & qPayIntegrator are about to get new names, logos & become Allevo brands) and the so-called qPI-Open, which, in short, means creating an open source version of qPayIntegrator. This was one of the first times we had a chance of discussing this idea with current customers of our product and of getting their opinion on the matter. I hope they weren’t only polite when saying it’s a bold and interesting approach.

By: Ioana Guiman

Allevo reached the 19th edition of its Solutions User Group and this meeting’s 7th Anniversary (UG1 was in November 2004). The agenda includes, besides the usual reports and news on Allevo’s products features, our events participations and plans for the near future, as follows:

1. Software services support: January-November 2011 Report

2. qPayIntegrator Software maintenance Report

3. Presentation of qPayIntegrator’s new features (for banks): qPI-T2, qPI-TREZ, qPI-SEN, qPI-STM

4. Presentation of qPayIntegrator’s new features (for corporates): qPI-TIPc

5. News&impressions from our participations at 2011 main events: SPIN

(International Payment Services and Systems) in Rome, EBAday in Madrid, Sibos in Toronto… and plans for next month at SOFE (SWIFT Operations Forum Europe) in London

6. Allevo’s outlook for the next two years

…and dialogue, guests opinions, during sessions, coffee breaks and lunch.

16 November 2011

Romanian Banking Institute’s atrium Bucharest

Agenda

09:30 Opening Petru Rares – IBR, Florin Georgescu – BNR, Radu Gratian Ghetea – ARB

10:00 Updates on the SEPA project – Rodica Tuchila (ARB)

10:15 SEPA for companies – Mircea Tomescu (BNR)

10:45 SEPA added value services – e-Invoicing – Răzvan Faer (TRANSFOND)

11:15 Break

11:45 e-SEPA – Innovative payments solutions – Rodica Tuchila (ARB)

12:15 Case study: RoSTEPS, a SEPAReady system – Laurentiu Dumitru Andrei (State Treasury of the MoPF), Sorin Guiman (Allevo)

12:45 The impact of adopting SEPA instruments for companies – Constantin Rotaru (ARB)

About a month ago our services team took a trip to Moldova to assist local banks with upgrading SWIFTNet to version 7.0. But other than that, it’s been a while since our last business visit over there.

We were glad today to gather representatives of 14 different banks (Moldova summing up 15 authorized banks all in all). Ion Stirbat, our Sales Director introduced Allevo to the new faces at the table and explained both to new and old acquaintances who we are, our rebranding story, what we do, what we’re specialized in, who our customers are, and what our main product portfolio consists of – qPayIntegrator, FMA, Esfera.

Then after, Corina Mihalache took over the floor and went into further details of our solutions specifically designed for banks. She revealed all features of qPayIntegrator, the accounts reconciliation functionality, the solution for workers’ remittances, built on top of SWIFTRemit, and last, but not least, PAYaaS.

We’re thrilled we tightened up the relationship with the land beyond the Prut river and we’re looking forward to a very nice collaboration.

By: Ioana Guiman

We’re organizing a special seminar on November the 10th in the Conference Room of Manhattan Hotel Chisinau, Moldova.

All banks in Chisinau are invited to joins us, see a full presentation of our services & solutions portfolio and see live demos of these.

Following the global greening trend, all support materials will be handed on USB sticks. The time of the participants will be rewarded with a surprise pack of souvenirs, meant to remind them of Allevo and of Romania.

For logistics reasons, as our seats are quickly being filled up, we kindly ask you to send a mail stating your presence at corina dot cornea at allevo dot ro if you wish to participate.

UPDATE: The event just ended, we were pleased to welcome our guests – banking institutions representatives. Allevo’s presentations and demos, held by Ms. Corina Mihalache, Business Analyst Allevo, and Mr Ion Stirbat, Sales&Marketing Director Allevo, were a good base to start an interesting dialogue in the Q&A session.

SWIFT Business Forum Romania, at its second edition, took place on the 3rd of November, in the Atrium Hall of the Romanian Banking Institute.

Allevo has been the organizing partner of this exclusive event, together with the Romanian Banking Association, the Central Securities Depository and SWIFT. Aiming for accomplishing Bucharest as a Major Regional Financial Center, this year’s Forum gathered almost 200 participants.

Allevo’s business analyst, Ms. Corina Mihalache, one of the panelists in the first session (Payments Panel), held the presentation “Financial Interoperability and Open Source”. Further more, in the solutions zone hosted by the event, Allevo had live demos prepared for the participants.

See the event’s AGENDA

LATER UPDATE: See the related article recently published on SWIFT’s homepage , briefing on the SWIFT Business Forum in Bucharest. The article brings up Corina Mihalache’s valuable delivered content & Allevo’s role to support the performance of the event.

Held in the Romanian Banking Institute‘s atrium

Bucharest, November 3rd 2011

The second edition of this event was organized with the support and contribution of the Romanian Banks Association, the Central Depository, SWIFT and last, but not least, Allevo. The event was a huge success, gathering almost 200 people doing business in the Romanian financial market. Extra chairs were needed and provided instantly by the hosts.

The highlight surely was the impressive SWIFT delegation, summing up no less than 8 participants, holding strategic positions within SWIFT: Andre Boico (Head of Pricing), Guy Beniada (Board Member, Managing Director, ING Belgium), Judit Baracs (Sr Account Director Payments Markets), John Falk (Securities Market Infrastructures), Nigel Evans (Sr Account Director Broker Dealers & Treasury), Stephan Kraft (Country Manager for Romania), Christian Kothe (Head of Central & Eastern Europe), Michael Formann (Head of SWIFT Austria). The first 6 delivered SWIFT’s message to the Romanian business community, using good content slides and the art of public speaking they all very well master.

The event was split into two sections: a payments panel in the morning and a securities panel in the afternoon.

Guy Beniada presented SWIFT’s strategy for 2015 and we could easily recognize things said at Sibos nearly one month ago in Toronto: lowering TCO, reducing costs, enabling interoperability and a few insights of Sibos itself.

We were proud to be reminded we are the only Romanian company exhibiting on the Sibos floor and we once again were invited by the SWIFT staff to be part of Sibos 2012. So it struck us that it would be a very good idea for the Romanian financial community to be better represented in this environment. We thought Romanian banks and financial institutions could think about building a shared booth at Sibos, just as banks of India have done over the past few years.

Andre Boico said two businesses are doing very well in Romania: securities and payments. Romania is back to growth and SWIFT has its eye on Romania and will monitor very closely the local market.

In the opening plenary , there were also statements from Petru Rares (Romanian Banking Institute), Radu Ghetea (Romanian Banks Association) who said the local banking system is a stable one due to the measures taken by the National Bank (read the full story in Romanian), Stere Farmache (Bucharest Stock Exchange), Felix Enescu (Gartner).

The payments panel was moderated by Rodica Tuchila (Director of the ARB) who introduced Luiza Lucaci (National Bank), Ionel Dumitru (TransFonD), Judit Baracs (SWIFT) and Corina Mihalache (Allevo). Corina made a full presentation on financial interoperability, reiterating the one given at Sibos and adding more insights on the status of our open qPayIntegrator project. The main idea of this project is creating a version of qPI on open source platforms and making this version available in an open source community as well. To tackle this initiative, we have spoken to a lot of specialists in open source community building, legal advisers, well known authors, possible partners, SWIFT’s innovation team, developers with experience in financial systems, consultants and so on. As Corina, said, we were surprised of how quickly this idea was embraced by all these people and how they immediately offer to actively contribute from this early stage of the project.

The securities panel was moderated by Adriana Tanasoiu (CSD) and she introduced John Falk (SWIFT), Catalin Chesu (National Bank), Gabriela Anghelache (CNVM), Gheorghe Tudor (CSD), Irina Savastre (UniCredit) and Nigel Evans (SWIFT).

John Falk focused on what Stephan Kraft called the “next step for Romania”: corporate actions. Nigel Evans talked about EMEA post trade services and so the day was concluded.

The solutions space at the back of the room housed the booths of CSD, SWIFT and Allevo and during the breaks interest was shown into both SWIFT’s solutions and Allevo’s offering for banks and qPayIntegrator, with all its business features. We’re available for any further questions on all open channels of communication.

Frankly I think this event could very nicely evolve into a two days yearly event, adding more subjects of interest to the agenda, summing more notorious panelists.

So let us all meet next year for another SWIFT Business Forum in Bucharest!

By: Ioana Guiman