The 8th edition of SWIFT Business Forum Romania was held by the Romanian Association of Banks on the 8th of November in Bucharest, with the kind support of Allevo.

Gathering around 100 representatives from financial institutions, the conference was focused on celebrating 25 years of SWIFT in Romania, along with debating challenges and opportunities for the financial banking industry, compliance issues and the inevitable digital transformation (a round table we were proudly a part of).

The opening plenary consisted of a SWIFT 2020 Strategy update, a SWIFT RTP update and what the strategy means for RO banks, as well as a presentation of the Romanian banking system 2020 vision.

The next topics of discussion were packaged in a 2-hour panel in which:

- Marianna Janssens (SWIFT) presented the Global Payments Innovation (GPI) initiative;

- Ruxandra Avram (National Bank of Romania) talked about PSD2 reshaping the payments business, as well as information security;

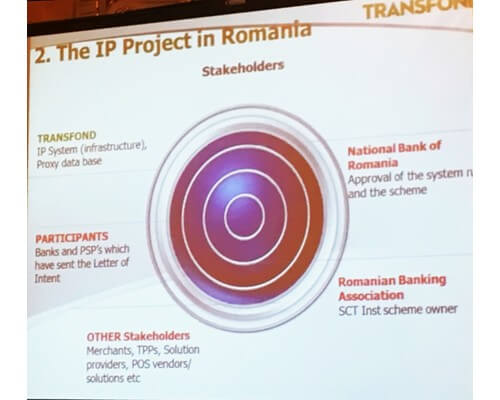

- Ionel Dumitru (TransFonD) showed the audience how the future of RON payments is “Instant”;

- Mihaida Meila (Central Depository) presented the securities market developments and announced the 10-year anniversary of her institution;

- Michael Formann (SWIFT) talked about reinforcing the security of the global banking system – CSP.

Panel highlights:

The No.1 counterparty for payments with Romania as the sender is none other than the US (over 20% of our international payments).

According to Capgemini’s report “The Currency of Trust: Why Banks and Insurers Must Make Consumer Data Safer and More Secure”:

- Either the information security management or the security policy are inadequate for 50% of banks.

- 79% of the financial institutions taking part in the survey are not confident about their ability to detect breaches.

Gizem Tansu (SWIFT) then held a focus session on financial crime compliance and the KYC Registry, stressing the importance of this secure shared platform for all banks and the fact that the documentation upload to the Registry is completely free.

Name Screening Service is another solution proposed by SWIFT, part of its support to the community in fighting financial crime, offering real-time online screening of single names and supporting effective sanctions compliance by enabling customers to efficiently screen single names of their own customers, suppliers and employees against sanctions, PEP and other lists.

Round table: The digital transformation – between opportunity and regulation

Allevo was represented at the round table by Sorina Bera (CEO), who talked about our current and future projects, including FinTP Connect (our PSD2 solution), FinOps Suite (part of the Treasure Open Source Software co-funded from the ERDF through the Competitiveness Operational Programme 2014-2020), as well as our Instant Payments approach.

Due to the rapidly-changing landscape of technology and regulatory compliance alike, software solutions providers must be one step ahead of all other players (be they banks, service providers or consultants), since their compliance to new regulations is based upon the formers’ ability to offer compliant solutions.

In fact, software solutions providers have to take the first step in terms of analyzing new regulations, in order to anticipate market needs and requirements, and in this endeavor we constantly consult with final beneficiaries, as a team, to come up with the best solution possible, one that really makes a difference.

Since we are all on the same side and have a common goal (compliance), team work is essential. Even though the regulator (in our case, the National Bank of Romania) was not part of this round table debate, they are in the same boat with the rest of us, considering that the ultimate goal of all regulations is to benefit the consumer most of all.

In terms of innovation, we strongly believe that its key purpose is to keep the customer satisfaction at the highest level possible and we keep that in mind when we develop all our products.

In the end, here are a few results of a Roland-Berger pan-EU study, who challenged 5 beliefs on digitalization:

- Customers request a digital banking experience – TRUE, and this is valid for all age groups, not only younger generations; it depends mostly on the levels of education and income. What banks can do is define relevant customer groups, compile digital offerings tailored to specific target groups and clearly communicate them.

- The higher the number of digital channels, the better – FALSE. The point is to develop end-to-end digital solutions to be able to address customers through the right channel, with a personalized offering.

- Online is revolutionizing banking – TRUE, but the possibilities are even greater, by offering additional value.

- The branch is dead – FALSE, but it needs to become more innovative! Banks should adapt the branch offering/service model and make it more attractive by adopting the right blend of innovative branch concepts.

- Banks are facing a trust issue in the digital world – FALSE. Trust in banks is nothing but an opportunity to offer secure proprietary apps and communicate the distinct value they add to customers’ lives, in order to reinforce mobile banking use.

Final thought: PSD2 will further accelerate the digital transformation and 78% banks plan to at least leverage the changes to open to new opportunities, if not even significantly benefit from the development. Moreover, half of these banks are looking to use PSD2 to develop an ecosystem with other partners.

We look forward to seeing you at SWIFT Business Forum Romania 2018! Thank you!

In Romanian:

Pentru informatii detaliate despre celelalte programe cofinantate de Uniunea Europeana, va invitam sa vizitati www.fonduri-ue.ro. Continutul acestui material nu reprezinta in mod obligatoriu pozitia oficiala a Uniunii Europene sau a Guvernului Romaniei. Proiect finantat in cadrul POC, Axa prioritara 2, Acțiunea 2.1, Prioritate de investitii 2b. Cod MySMIS: 115724, Nr. Contract Finantare: 101/16.08.2017.