I don’t know if I should start by quoting Chris Skinner “At 40 years old, is SWIFT going through a mid-life crisis”, but I can say the first day of Sibos gathered quite a crowd. Maybe that’s why the wi-fi connection didn’t stand a chance, not that this should have been an excuse. Guess I will be gentler and stick to what we did here today, even though writing about it on the blog has been quite a challenge (network connectionly speaking).

The main event on Allevo’s agenda today was the Gen Z Banking for People session in the Innotribe tunnel. The motto was do banking for the people, make it easy for them to send or receive money, make it cheap, make it safe and make it fast (real-time).

We wanted to propose a solution to the financial inclusion and remittances problem, one of the big problems that emerged in the context of urbanization and globalization. A solution that will take a model that is known to work in urbanized societies and in smart cities and to replicate and adapt it in rural areas. The delivery of pensions, small money transfers, unemployment aid can be done electronically and can save people a lot of bureaucracy, time and even money. On top it can save banks and governments a whole lot of money.

In the end, it’s a solution that can help improve the lives of so many people simply by using Gen Z technology and devices to link and automate the money flows that haven’t been able to keep pace with technology.

https://prezi.com/embed/8hjm5reo0dfj/?bgcolor=ffffff&lock_to_path=0&autoplay=0&autohide_ctrls=0&features=undefined&disabled_features=undefined

Immediately after our Innotribe session, the opening plenary session started. No so many news, though, no mention of the 35 years passed since the first Sibos. They did talk about a next step and that is taking an interest in fighting cyber crime. Apart from the plenary, in terms of sessions today, Future of Money had quite a success among participants, filling up the room once again.

For tomorrow, we have prepared two more events.

First, early in the morning, we are looking forward to welcoming you in Community Room 3 at 9:30 to get acquainted with the Financial Tribes of The Future. Our panellists will answer questions like: What are the greatest 21st Century challenges that the financial services industry faces? Is the economy outlook entirely digital? What’s the future of banks and how are they going to intermediate payments? Are there grounds for cooperation or competition only between financial institutions and bank 3.0 IT companies? How will knowledge be shared within this space? Are we looking at many smaller tribes united by the same goals and interests? Or at large scale and more strictly regulated communities driven by the desire to make things work? And of course, we welcome any question from the audience.

Later in the afternoon, we’ll have the first of the two open debates, our new approach for bringing some interesting topics to you into a friendlier format, one that allows participants to freely speak their mind and share their ideas in a completely collaborative atmosphere.

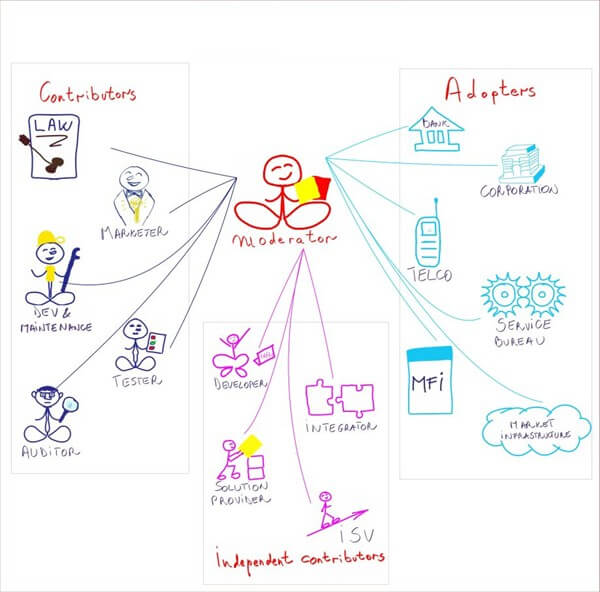

So, between 15:00-15:30, at our stand B97, we’ll talk about the challenges of building an open financial community. But I don’t want to spoil the surprise, so just come by and join our discussion.

Until tomorrow, I’ll just leave with one think i noticed while walking among the stands at Sibos. Quite a few exhibitors are offering stress release rubber balls. Is the banking industry so stressed this year? If you have any opinion, drop us a comment or just tweet it to @A11evo.